The Best Gift

The best gift you can give to your child is a quality education of their choice and passion. But quality education in today's world is not cheap.

A study by Zurich International Life estimates that educating a child in the UAE could cost up to AED 1.00 million from pre-school to university

This figure includes fees and expenses during two years at pre-school, six years at primary school, six years at secondary school, and three years at a UK university.

Impact of Inflation on Higher education

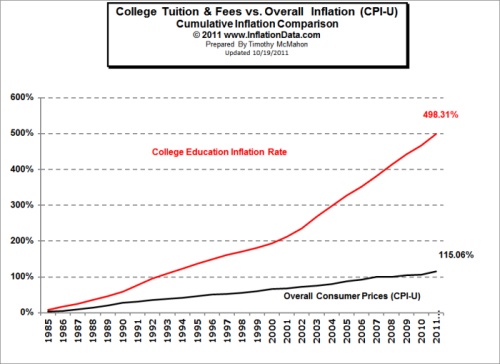

School & College fees are soaring each year, advancing far in excess of the inflation rate.

The overall inflation rate in the US between 1986 - 2011 was 115.06%. On the other hand, during the same time, tuition increased a whopping 498.31%. See the graph below...

For example, if the cost of college tuition was $10,000 in 1986, it would now cost $21,500 if tuition fees had increased as much as the average inflation rate but instead, the fees are $59,800 or over 2 ½ times the inflation rate.

The inflation rate in UAE and India is much higher than the US, and hence the cost of higher education is soaring more rapidly than ever before.

The average cost of higher education ( Average of US, UK, Canada, Australia & UAE) today is approximately USD 35,000 per year, and a 4-year graduation will cost at least USD 140,000.

On applying 5.00 % inflation the amount required in 10 years would be approximately USD 228,000/-.

With all the current expenses, volatile job markets, and struggling economy as a parent it could be a challenge to come up with such money.

Savings could take the back seat due to financial constraints, lack of awareness, procrastination, or lack of qualified and trustworthy advice.

Quality education of their choice is every child's basic right and the above challenges should not shatter your child's dreams.

Unbiased Professional Advice

I am an Independent Financial Advisor with professional qualifications and more than 15 years of experience in the banking & financial services industry. I can provide unbiased professional advice helping you save and invest for your child's future.

Read the following blog posts to know more or arrange a free consultation;

- 5 Simple Steps To Save & Invest For Your Child's Education

- Investing for your child's higher education? - 7 important points to consider...

You can also arrange a free consultation by clicking the following link;

Click here to arrange Free Online Consultation.