Retirement planning, Investments, Savings

How to grow wealth using the Pay Yourself First Strategy?

Every time you receive your paycheck, you pay so many people!

You pay your...

Do you want to buy a car or a house?

Pay off your debt?

Or Take a dream vacation?

But you are tired of living paycheck to paycheck!

I bet you want to do more with your money!

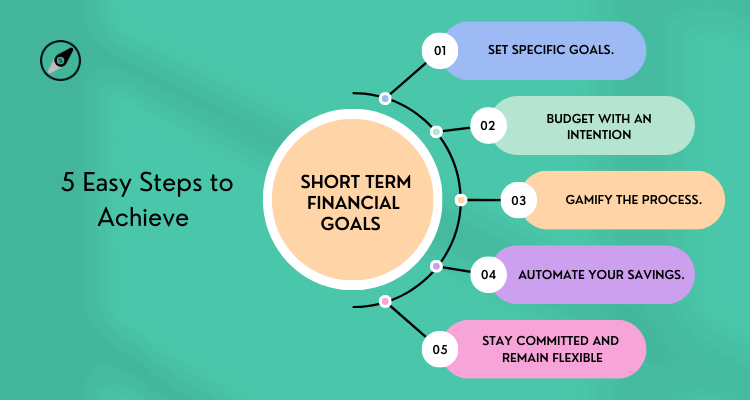

This article discusses the five easy steps to achieve your short-term financial goals and take charge of your finances.

Goals that you can achieve between 1-3 years are known as short-term financial goals. They can be anything from saving up for a down payment on a house, paying off debt, taking a dream vacation, or buying a luxury car.

Setting and achieving short-term financial goals is crucial for enhancing your financial well-being. It gives you a sense of progress and motivates you to earn, save and invest more to create wealth and achieve financial freedom.

There are many reasons why short-term financial goals are important. Here are a few of the most important reasons:

Saving and investing for short-term financial goals helps you avoid borrowing, and thus you build a habit of delayed gratification. This can be quite useful in helping you enhance your overall well-being.

When you have specific short-term goals, it's easier to track your progress and make sure you're on track to reach them. This can help you stay motivated and avoid overspending.

Short-term goals can help you build the foundation for your long-term financial goals. For example, if you want to retire early, you may need to start saving money now. Setting short-term goals can help you get started on the right track.

When you have short-term goals, and you're making progress towards them, it can give you a sense of accomplishment and confidence. This can be helpful for your overall financial well-being.

The first step to achieving your financial goals is to set specific goals.

Determine, why and what exactly do you want to achieve?

How much money do you need?

When do you want to achieve your goal?

Once you know what you want to achieve, you can start to develop a plan to get there.

Generally, people think that a budget is for making ends meet or managing expenses within income.

Contrary to popular understanding, A budget should help you do more with your money.

Your budget's real purpose is to optimize your income and expenses to generate an investible surplus to achieve your short and long-term financial goals.

There are many different budgeting methods out there, so find one that works for you and stick to it.

You can also download and use "The Forward Cashflow Planner." It can help you plan up to 12 months' cash flow in advance and in multiple currencies.

Gamification is an exciting way of achieving your financial goals. It makes it fun, gives you something to look forward to, and helps you break down big goals into smaller pieces.

Break down your short-term financial goals into bite-size milestones and small rewards/treats for reaching there. It makes the whole process fun and keeps you on track and motivated. There are many apps for this, you can also use an Excel spreadsheet as well.

One of the best ways to make sure you're saving money is to automate your savings. This means setting up a system where a certain amount of money is automatically transferred from your current account to your gloak linked savings account each month.

Virtual bank accounts like Liv have such features to help you with gamification and savings automation.

Finally, remember that achieving your short-term financial goals requires commitment and flexibility. Stay focused on your objectives, but be open to adjusting your strategies if circumstances change. Financial journeys are not always linear, but with determination and adaptability, you can overcome obstacles and achieve success.

Achieving your short-term financial goals is not easy, but it is possible. By following these 5 easy steps, you can take control of your finances and reach your goals sooner than you think.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Every time you receive your paycheck, you pay so many people!

You pay your...

-2.png?width=300&name=Financial%20Planner%20or%20Financial%20Advisor%20(350%20%C3%97%20250%20px)-2.png)

A majority of residents don’t have a written financial plan.Maybe you don’t either.

"Every financial worry you want to banish and financial dream you want to achieve comes from...