life insurance, Zurich Futura

How to improve Zurich Futura Fund Performance?

Are you looking to get the most out of your Zurich Futura plan?

Steve Cutts has a Youtube channel with only 12 videos in 9 years but has more than 1.2 million followers. In 2012 he released a video titled "MAN". As of today, this video has more than 51 million views.

This 3.36 minutes video highlights the damage caused by the Man on the planet in pursuit of profits and share value.

Thanks to many such awareness efforts, social media, white papers, and lobbying by pro-environment groups in the last few decades, the corporate world, policymakers, and regulators have taken this cause seriously.

They now are keen to reverse the damage as quickly as possible by focussing on Sustainable Energy instead of carbon fuels. Many companies and governments have pledged to become carbon neutral between the years 2030 to 2050.

Sustainable Energy as an industry has grown by leaps and bounds, with trillions of dollars invested for this cause over the last few years.

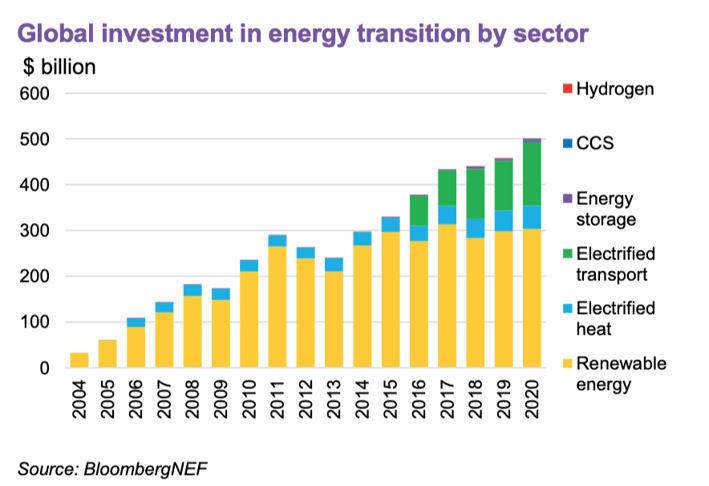

The following chart shows the amount of investment in the energy transition sector-wise;

In the year 2020, global investment in the low-carbon energy transition was $501.3 billion, up by 10+% from 2019 and by more than double from 2010.

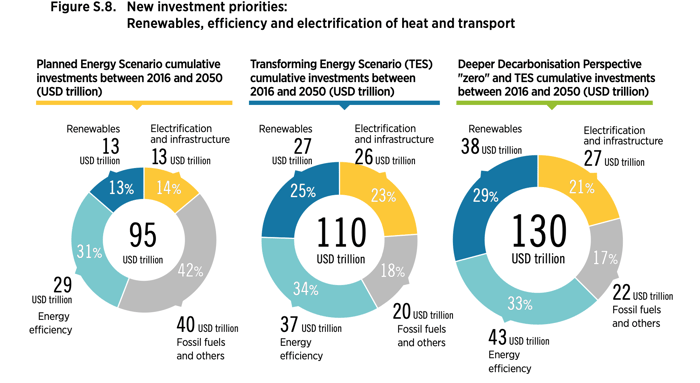

Additionally, an investment of $110 trillion US Dollars globally is estimated to flow into Sustainable Energy and ancillary sectors by 2050, creating a massive opportunity for investors to capitalize on this momentum to create wealth.

Source: GLOBAL RENEWABLES OUTLOOK REPORT - 2020

Investors preferred to stay away from capital-intensive renewable energy projects like Wind and Solar and electric vehicles until a decade ago. They perceived this sector as risky and less rewarding.

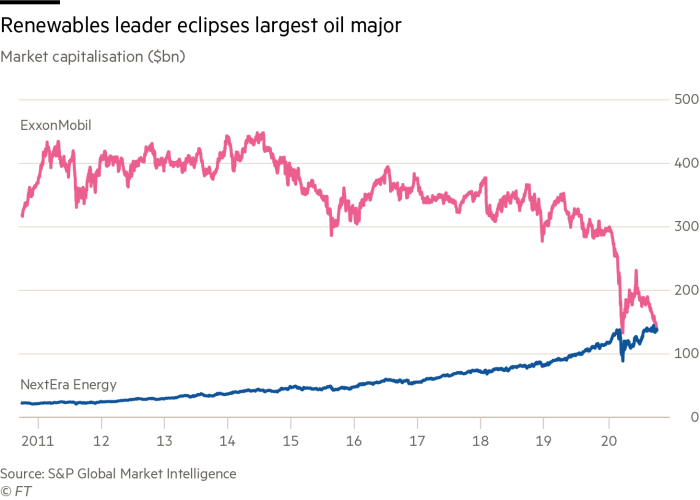

Instead, they continued to invest billions of dollars in hydrocarbon projects, particularly in the USA, boosting the Shale Oil projects, helping America becoming energy independent.

Now the s(t)ands are swiftly shifting towards Sustainable/Renewable energy sectors. Companies like NextEra, and Tesla are the new favorites.

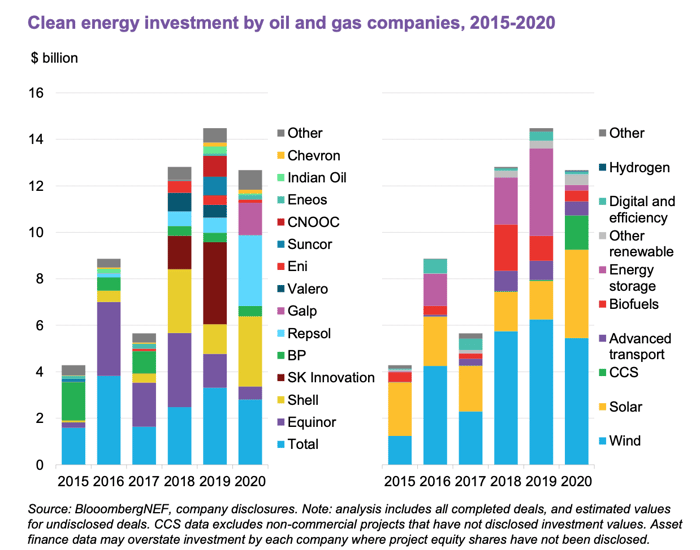

This sector has gained so much popularity that even Oil and Gas companies have started investing in it substantially.

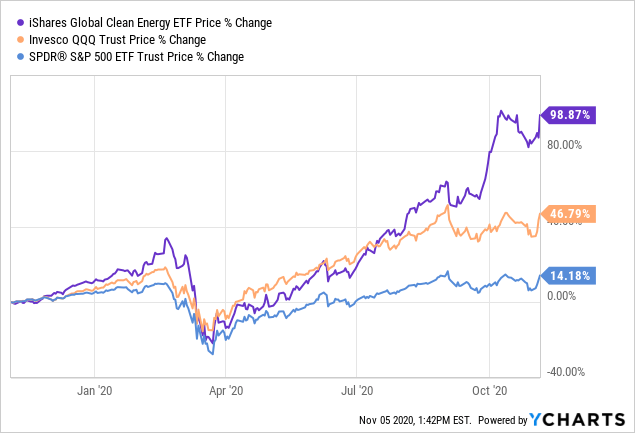

Post Biden Election, stock prices of Sustainable energy companies soared quite substantially in 2020. However, it appears that the party is just getting started.

The world is now more committed to reduce its Carbon footprint and focus on clean energy alternatives than ever before. This trend is very likely to continue over the next few decades.

Source: https://seekingalpha.com/article/4387416-top-5-performing-green-energy-stocks

Source: https://seekingalpha.com/article/4387416-top-5-performing-green-energy-stocks

In light above, including this sector in your portfolio can be a good idea in the medium to long term. While there could be intermittent volatility due to macroeconomic factors in the short term, this sector is likely to do well in the medium to long term horizon.

As an Independent Financial Advisor, I can help you create a Holistic Financial Plan and a Robust Investment strategy.

We can build a diversified investment portfolio including different sectors like Sustainable Energy, technology, and healthcare, helping you grow wealth.

I can also help you regularly review your portfolio and rebalance it when necessary.

Click the link below to arrange a free consultation and start investing in stocks.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Are you looking to get the most out of your Zurich Futura plan?

Critical Illness Insurance-Real Stories That Prove Its Value

Zurich Simple Wealth, as the name suggests is a simple & straightforward lump-sum investment plan...