When you invest $10,000 at a 10% growth rate, it will grow to $16,100 or 1.6 times in 5 years. In 10 years, it will grow to $25,930 or almost 2.6 times.

Imagine by how much it will grow in 25 years?

It will grow to become $93,130 or 9.3 times, just by keeping the money invested and reinvesting the profit/interest.

This is the Power of Compounding.

This is the Power of Compounding.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”― Albert Einstein

Your success as an investor is a product of two essential ingredients

- The rate of return

- the length of time you remain invested.

Of late, investors are more focused on the rate of return and much less on the length of the investment. Little do they realize that the magic of compounding needs both these factors to work in tandem when looking to create long-term wealth.

So while looking to get better returns on your investment, you should also remain invested for a longer horizon to get the maximum benefit of the magic of compounding.

Bank Deposits vs The Stock Market/Mutual Funds

Unlike in the past, the bank rates are not so rewarding; hence, investors are now considering mutual funds, ETFs, and stock market investment to grow wealth.

Also, unlike bank returns, Mutual funds or market-linked assets can be volatile with potential risk to capital invested. Hence it is crucial to ascertain your investment horizon and the ideal risk-reward balance to build a robust investment portfolio.

Regular Savings or Systematic Investment Plan

As the Magic of Compounding, the systematic investment approach is equally powerful in helping you accumulate capital, grow wealth and mitigate market risks.

As the Magic of Compounding, the systematic investment approach is equally powerful in helping you accumulate capital, grow wealth and mitigate market risks.

Benefits of Regular Savings or Systematic Investment Plan

- You can start with a small monthly investment.

- It helps you build a disciplined saving and investing habit.

- Dollar-Cost Averaging - Dollar-cost averaging helps you benefit from the market fluctuations. When the stock prices fall, You buy more units and buy lesser units when the stock prices increase, thereby averaging your buying cost.

- Diversification - You can invest in a diversified portfolio of Mutual funds with a SIP or regular savings plan.

High-Octane Blend

Individually both the Power of compounding and the SIP investment approach are very powerful. When you combine them in the right way, they can exponentially enhance your wealth accumulation process.

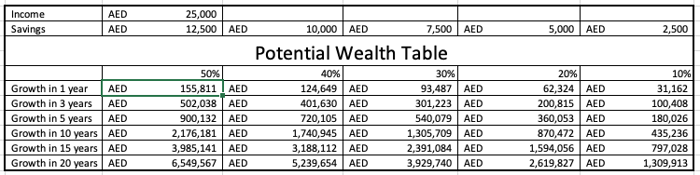

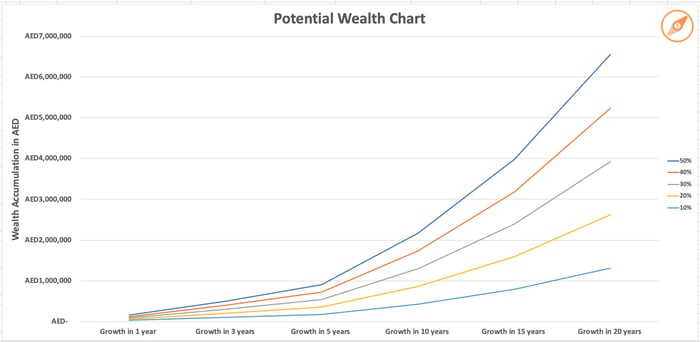

Here is a Potential Wealth Table showing the combined power of the Magic of Compounding and Systematic Investment;

Financial Planning and Investment Advice

As an Independent Financial Advisor, I can help you achieve your financial goals by harnessing the Power of Compounding and the benefits of a Systematic Investment Plan.

We can build a diversified investment portfolio to suit your investment goals, horizon, and risk appetite.

I can also help you regularly review your portfolio and rebalance it when necessary.

Click here to arrange a free consultation.