Dollar based insurance, Investments, NRI investment

Why NRI should invest in Dollar-denominated Insurance in UAE?

NRI Insurance & Investments in US Dollar

When it comes to NRI insurance and investment, many...

When people want to save money, they usually put their net disposable income into a bank account so that it grows into a sizeable capital.

These funds can be used to achieve financial goals like; property investment, funding for children's college education and retirement, etc....

While their money is relatively safe, the bank only pays a minuscule rate of interest. Not only the returns are limited, they never keep pace with the rampant inflation, decreasing the purchasing power of your money saved.

Although putting money in a savings account is a sure bet, your gains will be minimal, given the extremely

A savings account is a reliable place for an emergency fund, whereas a market investment is not.

Learn more about investing, read my article - How to invest money in UAE, using 3 Bucket Investment Approach…

Banks in UAE offer interest rates between 0.50 % - 1.75 % on different types of savings accounts, while the inflation is around 4% - 5%, the purchasing power of your savings decreases by 3% - 4% every year.

For Eg If you have a deposit of AED 100,000 in a bank, earning 2% interest, by the end of the year, the account value would be AED 102,000.

If we assume an inflation of 5.00 % per anum, you would need AED 105,000 next year, to buy goods or services, currently valued at AED 100,000/-. Which means you will have to shell out an additional AED 3,000/- next year to buy same value of goods or services.

The best way to beat inflation is to put your money to work, instead of you doing all the work for money, i.e.

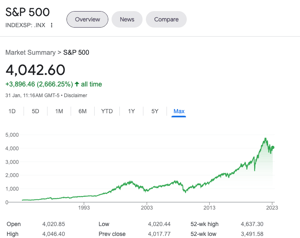

Investing can be much more rewarding, than just beating inflation, if a

Investing in a portfolio of multiple asset classes like; Equities, Bonds, Mutual Funds, ETFs, Commodities and Real Estate can potentially grow your investment by 10% - 12% average, helping you beat inflation.

When looking to invest, it is important to consider the following;

Investment Plans like, Investor Advantage and Investment platforms like Ardan can help you invest your disposable income efficiently and beat inflation, which savings account in a bank cannot.

To know more about investing to beat inflation and to help you achieve your financial goals, call me on +97150- 2285405 or register to arrange a free initial meeting.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

When it comes to NRI insurance and investment, many...

The dance of greed and fear, orchestrated by exit polls, lost and made trillions of rupees in a...

Don't look for the needle in the haystack. Just buy the haystack! - John C Bogle