5 smart reasons to buy home renters insurance in Dubai

I was catching up with a few colleagues on zoom a few days ago, and we were chatting about how long...

Home and Contents Insurance is easy to understand, easy to avail and very affordable.

Despite this most of us comfortably ignored it, until the recent Fire accident in Sharjah and Dubai.

People will talk about it for 2 to 3 days and slowly forget, assuming that nothing will happen or that the possessions they have are not significant enough to be insured.

Many people believe that Home and contents insurance is only for the rich, who have big assets and they also believe that it costs a lot to insure their home and contents..

Contrary to popular belief, Home and Contents Insurance is useful for every individual, whether a homeowner, tenant or landlord.

You will be surprised to know that it is very affordable, in

What is Home and Contents Insurance?

For most people in UAE, their home is their biggest asset, not to mention all the valuable items inside.

Home and Contents insurance covers a loss or damage to your Home and or all the valuable items within your home including Furniture, Fittings, Electronics, Electricals, Art, Jewellery, wardrobe and other priceless valuables.

Worldwide Coverage to personal belongings like Jewellery, Watches, Laptop and other valuable items against the following risks;

Before you buy Contents and Personal Belongings Insurance, take an inventory of your contents & belongings.

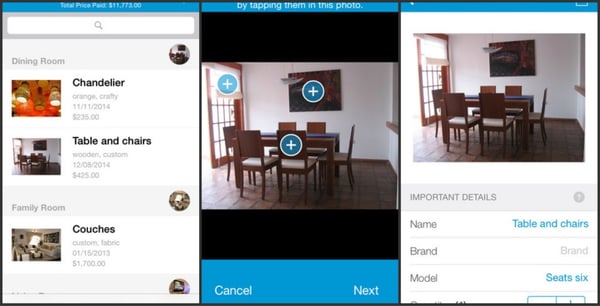

An easy way to conduct a home inventory is to walk through your house or apartment with a video camera or a smartphone video on while giving a brief description of the things that are the most valuable—like your big-screen TV, computer, antique furniture, major appliances and other pricey belongings.

You can also use the Allstate Digital Locker Smart Phone or Web application, to catalogue the items you own. Once you have the list, it will be a lot easier for you to figure out how much coverage you need. And, it may help if you ever need to file a claim.

The next step is to decide, how much you would want each content to be insured for?

You can either calculate the Actual Cash Value of the asset(Current Value) or the replacement cost of the asset.

For eg: If you bought a flat screen TV, 2 years back for AED 5000/- and the current cash value of that TV may be around AED 2,000 or less, while the cost of replacing with a similar TV might still be around AED 5,000..

It is up to you to decide which value you would want to choose for insuring your assets and arrive at a total value of the assets to be insured.

Call me on +97150-2285405 or write to me by clicking here, to help you decide and avail the most suitable solution for you.

With Home and Contents Insurance you can afford to relax, knowing that you are covered in the event of loss or damage to your home, contents and or personal belongings.

What about you? Do you have Home and Contents Insurance?

If not have you thought what will happen if your home was destroyed in a fire?

Leading insurance companies like Orient AIG, AXA and RSA provide comprehensive home and contents insurance in UAE.

To know more and to avail Home and Contents Insurance call on 0502285405 or write to me by clicking here

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

I was catching up with a few colleagues on zoom a few days ago, and we were chatting about how long...

Mortgage Life insurance is a policy designed to safeguard your home loan against unexpected life...