Financial Planning

What is the First Step towards Financial Security?

As a financial adviser, I meet many individuals of different nationalities and different economic...

2025 is a year brimming with opportunities to elevate your financial game. Whether you're looking to build wealth, secure your future, or create new income streams, this guide is your roadmap to powering up your finances.

Use this optimism to power up your finances.

Build ambitious financial plans, upgrade your goals and try to reach the next level.

Plan to build more wealth and to give your loved ones better platforms to launch their future.

Aim to create additional streams of passive income plan and to upgrade your retirement lifestyle with your efforts today and the next few years.

Don’t let this optimism fade away into nothing.

Rework on your budget to optimise your income expenses to create an investable surplus consistently, This is your key ingredient for building wealth.

If you do not have budget already, use this Expat Advantage Budget to get 12 months overview of your finances.

It is also easy to drift in to the optimism to enhance lifestyle and splurge on things that you would not do other wise. I am not saying you must not splurge, If not in good times, then when do you enjoy the niceties of life.

I am just saying that it is also important to continue building wealth through disciplined savings and investing, and if possible enhance the scope by as much as you can.

Split your earnings in the ratio of 50:20:30.

50% for needs and wants, 20% for luxuries and 30% for savings.

Why 30% savings?

Residents in the UAE tend to have relaitvely higher disposable incomes, since there is no personal income tax. Also, most of us are expats, who have come here with a primary objective of saving more money and building wealth, faster.

Hence the 30% savings recommendation. If you are not here yet, start now and keep working towards the 30% savings goal.

The three key factors for building wealth are;

Savings and investing

Time

Growth in value.

The first and second aspects are largely in your control, while the third is not in anyones control and usually is sporadic.

Start investing early, continue to invest on a regular basis and stay invested for as long as possible. Take charge of aspects in your control and leverage on the growth when it comes.

It is also easy to be carried away by the optimism to invest in assets that are already inflated and their values could go down sharply, when the tide changes. Such corrections typically take months to years to recover, which can be a mental put off towards investing and an impediment your wealth accumulation goals.

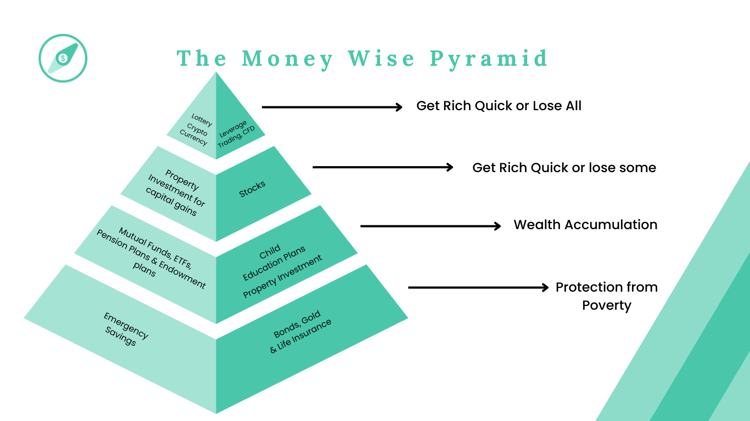

Now is the time to take extra caution and invest in quality assets, that are likely to hold its value or bounce back quickly after a correction. Chose your asset allocation wisely.

Do loads of research and look for quality assets that are low or moderate in valuation for investing.

Consult a financial advisor or an investment advisor to assess your risk and align your investment strategies accordingly.

This is also a year to set greed aside, book profits and rebalance your portfolios. It is easy to be carried away by the optimism and wait for the markets to go further up, but you never know, bears could be lurking around the corner, waiting to pounce at any time.

Once the markets have gone down, you may lose all or some of the growth achieved until now, and it could take a few more months or even years to see growth again.

When a wicket or two falls on cricket, the batsmen on the crease tend to shed the extravagant shots and focus to putting an innings together by adding ones and twos, with occasional boundaries here and there..

Similarly, during times of adversity we tend to cut corners on insurance, investments and other crucial protection aspects that do not provide instant gratification or relief.

Now is the time to revisit your protection needs and financial goals, to ensure that your financial pyramid's foundation is strong and robust.

Also, now is a great time to build and or augment your emergency savings bucket.

The cornerstone of financial success in 2025 is adaptability. Stay curious, be disciplined, and embrace opportunities for growth. Remember, financial freedom is a marathon, not a sprint.

By adopting these unique strategies and taking actionable steps, you’re not just managing your money—you’re shaping your future. Let this year be the turning point where you powered up your finances and built a legacy of financial security and prosperity.

Ready to take the first step? Schedule a personalised consultation to create a financial plan tailored to your goals. Click here to Power Up your Finances.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

As a financial adviser, I meet many individuals of different nationalities and different economic...

Everyone’s financial and life situation are unique, and so are our goals; aren't they?

This is...

Urban slavery is real. But it doesn’t look like what you’d expect.