Zurich Education Savings Plan: A Smarter Way to Fund Your Child’s Education

The cost of quality education is rising faster than most families can keep up with.

Providing your child with the best opportunities now requires more than good intentions. It requires a strategic, disciplined, and future‑proof savings plan.

The Zurich Education Savings Plan (ESP) is designed exactly for this purpose.

Powered by AI and backed by Zurich International Life, it gives parents a structured way to plan, invest, and protect their child’s education fund with confidence.

🎓 What Makes the Zurich Education Savings Plan Different?

Zurich’s ESP isn’t just another savings plan; it’s a complete solution that integrates Planning, Investing, and Protection in one efficient package.

- AI‑driven planning

- Globally diversified investing

- Low‑cost index funds

- Built‑in Premium Protection for parents

- Flexible contribution options

It gives you clarity, control, and peace of mind; everything a parent needs when planning for their child’s future.

🤖 AI‑Powered Education Planning for Precision and Clarity

One of the standout features of the Zurich Education Savings Plan is its AI‑driven Digital Planning Tool, which builds a personalized roadmap based on:

- Your child’s age

- Preferred country of study

- Years left until university

- Current and projected tuition fees

- Inflation and cost trends

This ensures your savings strategy is accurate, realistic, and tailored to your child’s education journey. You can adjust the plan anytime as your goals evolve.

👨👩👧 Child‑Focused Structure With Full Parental Control

The Zurich Education Savings Plan is set up in your child’s name, ensuring the funds are dedicated solely to their education. As the parent, you remain the policy owner and decision‑maker.

Ownership options include:

- Single Ownership — simple and streamlined

- Joint Ownership — shared responsibility between parents

This structure protects your child’s future while giving you complete control over contributions and investment choices

🛡️ Future Premium Protection: Your Child’s Education Stays on Track

Life is unpredictable. The Zurich Education Savings Plan includes an Optional Future Premium Protection, ensuring your child’s education fund continues even if something happens to you.

If a parent passes away or becomes permanently disabled:

- All future premiums are paid into the plan as a lump sum

- The education fund continues to grow

- Your child’s dreams remain protected

Insurance options include:

- Cover for one parent

- Cover for both parents

- Joint‑life first‑claim basis

This is one of the strongest safety nets available in any education savings plan.

💰 Flexible Contributions That Fit Your Budget

The Zurich Education Savings Plan adapts to your financial situation with multiple contribution options:

- Start with As low as USD400

- Regular premiums — monthly, quarterly, half‑yearly, or yearly

- Additional single premiums — top up anytime

- Catch‑up contributions — stay on track even if you miss payments

This flexibility makes long‑term saving achievable for every family.

📈 Low‑Cost, Globally Diversified Investments With Vanguard Index Funds

Your child’s education fund is invested through index funds, managed by Vanguard Asset Management, one of the world’s most trusted investment firms.

ZAP funds include:

- Vanguard Global Stock Index — long‑term growth

- Vanguard Global Bond Index — stability and income

- Vanguard Emerging Markets Index — high‑growth potential

🎯 Smart Investment Strategies Tailored to Your Risk Profile

The Zurich Education Savings Plan offers five risk‑based ZAP strategies:

- ZAP 100 — maximum growth

- ZAP 80 — aggressive growth

- ZAP 60 — balanced

- ZAP 40 — conservative

- ZAP 20 — low risk

Each strategy automatically rebalances to maintain the right asset allocation.

You can also add SmartRisk Taper, which gradually reduces risk as your child approaches university age; maximizing growth early and protecting capital later.

This means your child’s education saving plan targets high growth in the initial years and slowly tapers down the risk to ensure capital preservation as it moves closer to the goal.

📉 Dollar Cost Averaging: Reduce Risk, Build Wealth Steadily

By contributing regularly, you benefit from Dollar Cost Averaging (DCA):

- Buy more units when markets are low

- Buy fewer when markets are high

- Reduce timing risk

- Build a stable, long‑term education fund

This is one of the most effective strategies for long‑term goals like university planning.

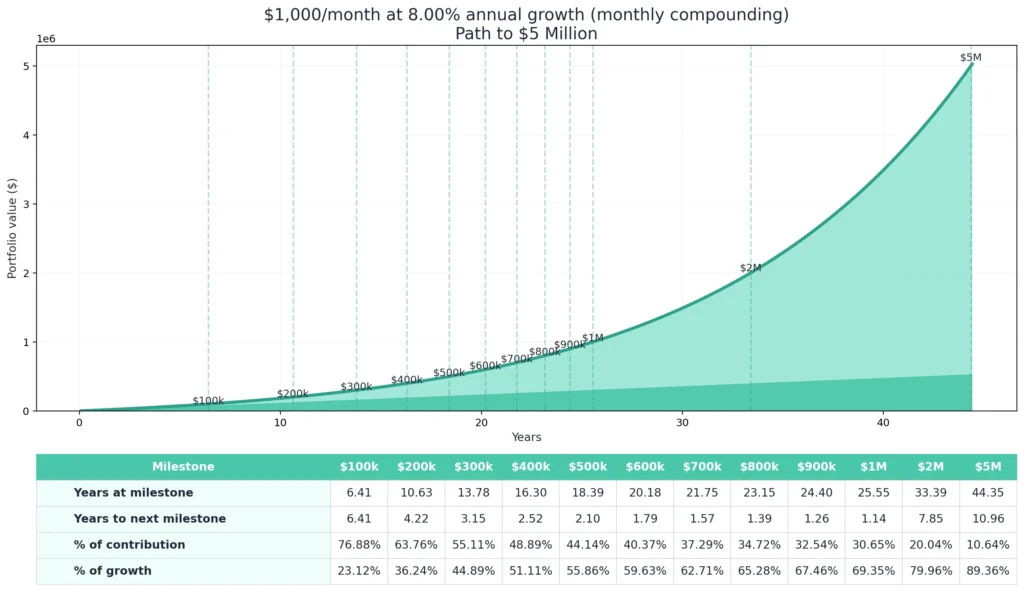

🔄 The Power of Compounding: Small Steps, Big Results

The Zurich Education Savings Plan reinvests dividends automatically, allowing your returns to generate more returns over time. The earlier you start, the more powerful compounding becomes—turning small monthly contributions into a substantial education fund.

Summary: A Plan Built for Your Child’s Success

Zurich’s AI-driven Education Savings Plan is designed to:

- Help you save consistently for your child’s higher education.

- Allow flexible contributions to adapt to your needs.

- Provide a safety net with the Future Premium Protection benefit.

- Offer a range of Zurich Allocated Passive funds to suit your risk profile.

Ready to turn your child’s education dreams into reality?

Click here to schedule a Discovery Call and let’s create a personalized strategy to secure your child’s future with Zurich’s ESP.

Don’t leave your child’s education to chance—connect with me today and let’s build a brighter future together!