Family, Money, Relatives

What to do when relatives ask you for money?

While most relatives would think a hundred times before asking you for money, a few may approach...

Did you know that credit card companies charge anywhere between 40%-47% interest?

While credit card debt is costly, interest rates on other loans have also increased in the last 12 months.

Mortgage rates have climbed steeply from 2.00% to 6.00%, and so have personal and car loans.

The era of cheap credit is now behind us, and for the next few years at least, interest rates are likely to remain high.

Here are a few proven strategies to get rid of debt;

While getting into debt is relatively easy, paying off debt is challenging. Getting rid of debt takes a lot of intent, discipline, planning, and hard work.

But the effort is totally worth it because life on the other side is relatively easy.

Imagine what all you can do by saving on the monthly interest you pay towards various loans and cards.

Keep repeating this exercise every month until you have paid off the debt.

Print or write this on a small card that could fit into your wallet. Please read it daily whenever you are tempted to use your credit card.

We know paying off debt is a challenge, so we must devise an effective strategy to destroy debt. Here are two proven strategies;

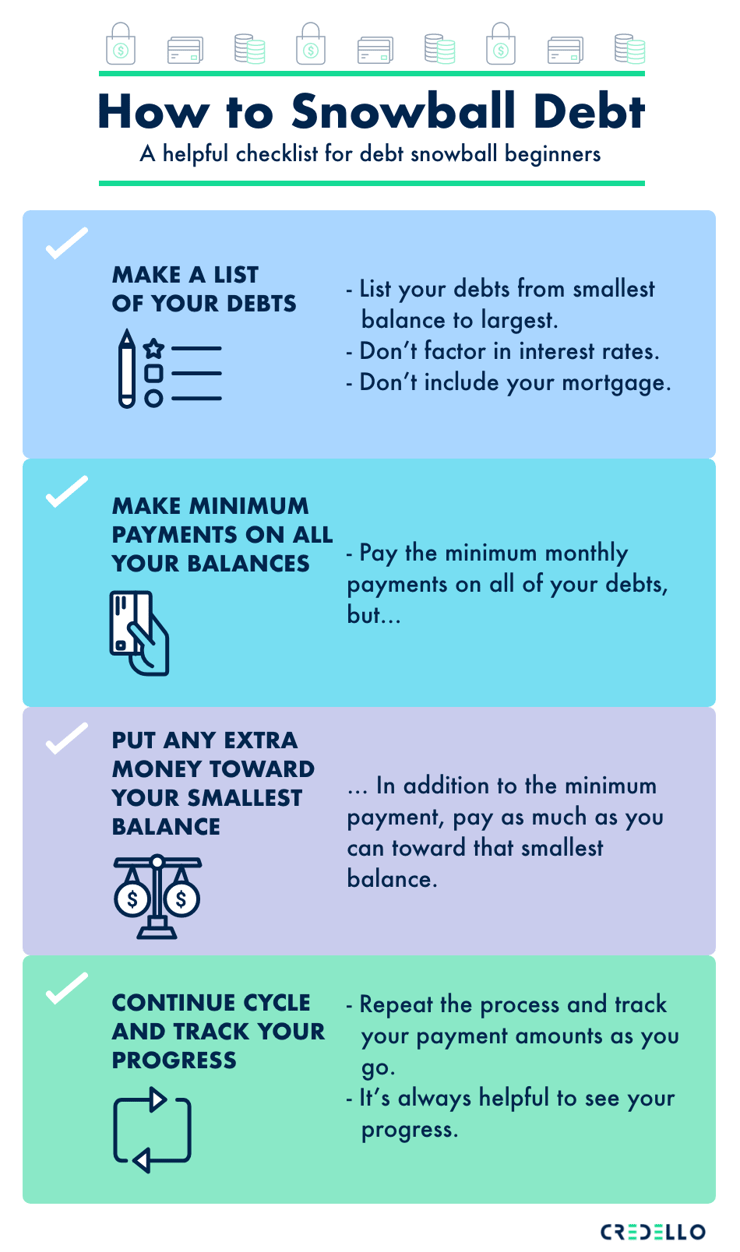

It is the most popular debt repayment strategy championed by Dave Ramsey, a personal finance celebrity.

Image Source: www.credello.com

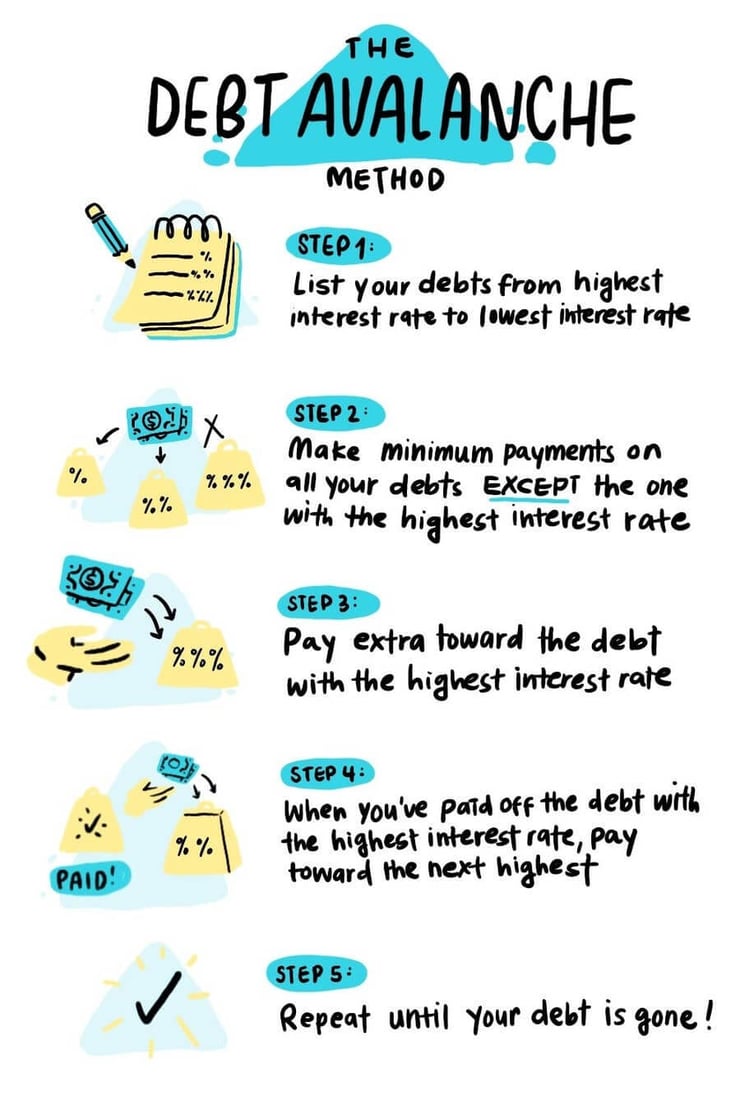

Image Source: www.credello.com

Image Source: www.buzzfeed.com

Use one of the abovementioned strategies to pay off your debt.

Stay focused, and, more importantly, keep working on your mindset. That is crucial to pay off debt and staying out of it.

Cheers to a Debt Free Life.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

While most relatives would think a hundred times before asking you for money, a few may approach...

I was a bit skeptical before launching the 30 Days - Win with Money challenge.

I wanted to be sure...

Shark Tank is one of my favourite reality shows…