Investments, Mutual Funds

What is a Mutual Fund and What are its Benefits?

"Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with...

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.

He and 19 of his friends had pooled money to buy the ticket.

Just like they shared the prize money, they would have shared the losses if they did not win. But each person would have only lost AED25, assuming they bought only one ticket.

Pooling in small sums of money makes it possible for people to participate in the draw even if they cannot afford the total ticket price.

Mutual funds also function similarly, where millions pool money for investing in different assets.

Welcome to Day 21 of the Win With Money Challenge.

Today we will learn the basics of Mutual funds.

A mutual fund is an investment vehicle that collects money from several investors and invests in one or more financial assets like Stocks, Bonds, Real Estate, Money markets, and precious metals.

It is run by reputed Asset managers and regulated by relevant authorities to ensure ethical operation.

A custodian holds the custody of assets of the fund to protect the investors' interest.

A fund manager with a team of analysts is appointed to make investment decisions to achieve the fund's objectives.

The following are some benefits of investing in Mutual Funds;

Mutual funds are broadly classified as;

A fund that is managed by a team of professionals who actively engage in research and active management of the investment portfolio.

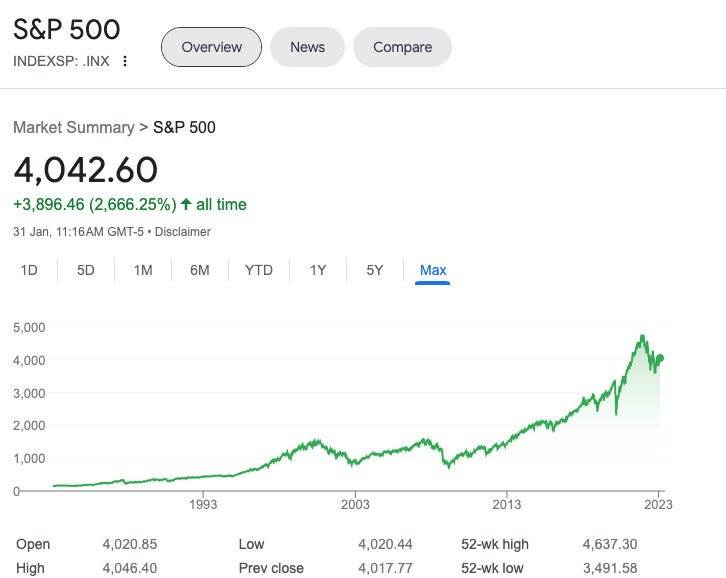

A fund that tracks the performance of an Index. These finds are also known as Index Funds.

For Eg: Vanguard S&P 500 Index Fund.

When you put money in this fund, it is used to invest in all the companies that make up the S&P 500 Index in the same ratio as the index.

So you get almost full exposure to the index's growth or reduction in value.

Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with picking individual stocks. Scott Cook

You can use Mutual funds to invest your savings if you cannot or do not want to invest directly in shares or other asset classes.

They can help you grow wealth while being able to save you time, money, and potential losses.

I hope this was useful in explaining the basics of Mutal Funds.

Feel free to contact me if you have any questions or share your feedback.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

"Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with...

Don't look for the needle in the haystack. Just buy the haystack! - John C Bogle

Luxuries of the past have become the needs of today; e.g. Private Schooling, Branded Clothing,...