DEWA IPO, IPO

Is DEWA IPO a good Investment?

In the last few days, many clients, friends, and colleagues have reached out to know if the DEWA...

Would you invest in a Pirate Stock Exchange?

Yes, there was an official Pirate stock exchange in Harardhare City, Somalia, between 2009 - 2013!

It was open seven days and week, 24 hours a day.

You could invest cash, kind, weapons, or information to get a generous cut of ransom spoils in return.

Now that I have your attention, let's talk about the good stock exchanges that deal in shares of legal companies.

Stocks, Shares, or Equity are names of fractional ownership in a company.

When companies want to raise money for capital, they invite public participation and list their shares on an exchange.

An exchange is a market where shares are publically traded. The following are some examples of exchanges;

Ordinary people like you and me can become joint owners of small to large multinational corporations by buying shares in these companies.

For Eg: Apple, Google, and Microsoft.

You may consider investing in shares because they typically provide much higher returns than banks, bonds, or other asset classes. They are your best bet to beat inflation and generate absolute returns.

For Eg: The Nasdaq 100 has returned 907% over 20 years to 2022. The India Sensex exchange grew by 1792%.

They could also provide a regular dividend (Share of profit) as income to the shareholders. For Eg:

You could invest in shares either for capital appreciation or dividend income or do both.

Yes, investing in stocks can be risky and volatile. Share prices could go up or down, depending on various factors like;

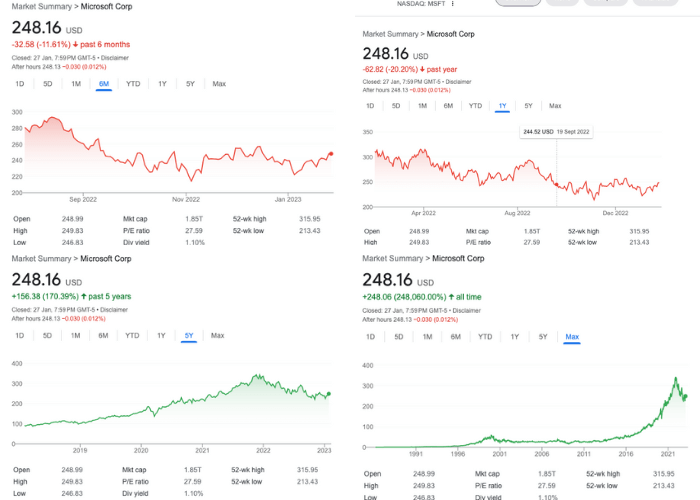

In the short run, the share prices of all companies are volatile, but in the long run, the share prices of good companies generally go up.

(Charts showing the volatility and growth of Microsoft's share price)

(Charts showing the volatility and growth of Microsoft's share price)

Careful stock selection, efficient diversification, and staying invested long-term are potential mitigants of stock investment risk.

Millions of people worldwide are growing their wealth by investing in stocks. In fact, 55% of Americans own stocks, and 10% of Americans own 84% of the US stock market.

Since the advent of Covid and the rapid improvement of technology, investing in stocks has become very easy.

People are carelessly investing their life savings in meme stocks and other risky investments, hoping to make a quick buck. There are better ways to invest.

On the other hand, some people invest in shares to build long-term wealth. They patiently wait for the right opportunity to buy and sell and are not swayed by the noise. They do adequate research by themselves or appoint trusted advisors to help them with investing.

It is crucial to invest only some of your savings in stocks and diversify the rest in the following;

Real Estate, Bonds, Bank Deposits, Gold, Cash, Endowment Plans, Pension Plans/Annuities, and REITs

Knowing the basics of Stocks was the task for Day 20 of the Win With Money Challenge.

See you tomorrow.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

In the last few days, many clients, friends, and colleagues have reached out to know if the DEWA...

The post provides a list of Medical Insurance companies in Dubai.

What goes up has to come down, and that is precisely what happened with Bitcoin and other...