Life Insurance Dubai

How to determine how much life insurance you need?

Life insurance is perhaps the only product you will buy, hoping you don't have to use it anytime...

Last week, I got a call from a young expat couple wanting to know if they should buy or continue to rent.

Like many expats, they were tired of renting and wanted to buy a house.

A place where their children would play and grow. A place where they could grow old, creating nostalgic moments to be relived in the future.

They also liked the idea of building equity into a property instead of just paying rent.

However, they were also going through a range of emotions like excitement, nervousness, stress, and confusion.

So the couple reached out to me for an emotion-free opinion that made financial sense.

To begin with, it was an excellent idea. The couple had lived in Dubai for over a decade and spent over a million dirhams in rent.

They were expecting to live here for at least 15-20 years, and buying a home could help them save a lot of money over time.

We sat down to discuss the idea and the numbers.

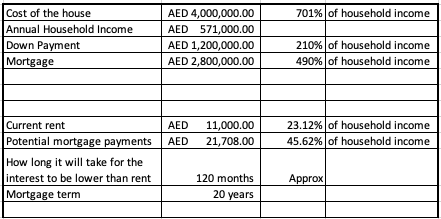

The house they wanted to buy was around 4 million dirhams.

The couple had money saved for different purposes and could pool it together to pay down 30% of the property.

They had no other loans and saved almost 40% of their income.

The mortgage was pre-approved, and everything looked well set up for buying the house.

I asked them how much rent they were currently paying. They said about AED11000 per month.

The proposed mortgage payment was around AED21,000.

Everything looked good as an idea until we put the numbers on an excel sheet.

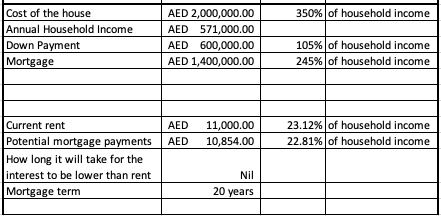

At the end of the exercise, we decided that they would not buy the 4.00 Million dirhams house but would look for a property in the range of 2.00 Million.

By buying a house within their budget, they are not only saving on interest. They are also not putting stress on their cash flow while being able to focus on other important goals like; Retirement and Children's higher education.

By spending only a portion of their savings on the downpayment, they also have enough for emergencies.

And most important of all, they would be able to pay the EMI even if one of them is unemployed.

Day 18 task is to explore the possibility of buying a house and see how well the numbers fit in.

You can use the following Thumb Rule from Day 12 to decide how much house you can afford;

Property Value = 3 - 5 times your annual household income.

If the numbers make sense and you want to buy one, go ahead and buy your dream home. If not, continue to rent until you have saved enough.

But I wonder what ChatGPT's response to this question would be! Will it take into consideration emotions, or will it only go with facts?

Hope you this is of value to you. Feel free to share your thoughts on the above.

See you tomorrow

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Life insurance is perhaps the only product you will buy, hoping you don't have to use it anytime...

What started as a local outbreak in Wuhan - China late last year, has now locked-up almost the...

Why Do Some Investors Lose Money While Others Build Wealth?