Would you pay 5 Trillion Dollars for a loaf of bread?

I am not sure🤔

But did you know that people in Zimbabwe did pay that much money to buy basic stuff like milk, bread, and rice? 😱

Prices went up so fast in Zimbabwe in 2008 that people had to carry money in wheelbarrows for essential grocery shopping.

Imagine how difficult yesterday's spend-only cash challenge would have been if you had to carry around so much cash!💰

The Zimbabwean government had to print 10 trillion Dollar currency notes to make things easy for people.

.jpeg?width=2560&height=1276&name=10%20Trillion%20Dollars%20(1).jpeg)

When the money's worth goes down, you would have to use more to buy the same amount of stuff. This is known as inflation.

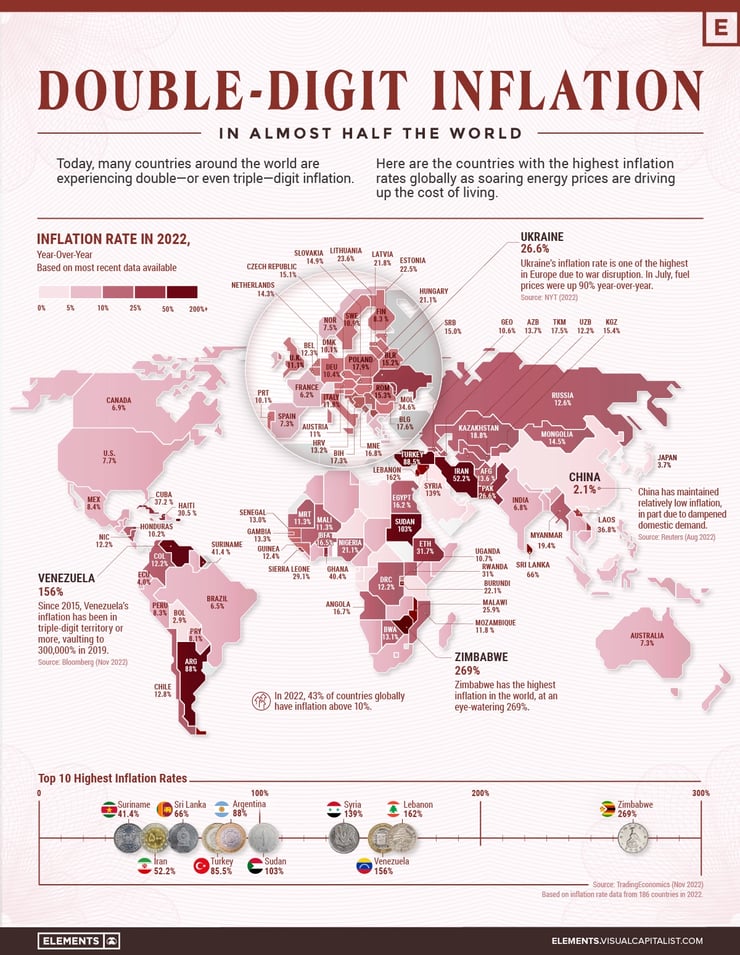

This is exactly what is happening now all over the world. See the chart below and click to view the larger image.

Here is cool animation explaining how it all started. In this cartoon, the Tuttle Twins learn about Inflation from Professor Milton Friedman, a Noble prize winner for his contribution to economics.

He teaches the children the basics of economics and money in simple language.

.png?width=979&height=540&name=Screen%20Shot%202023-01-18%20at%208.06.44%20AM%20(1).png)

How to tame the inflation monster?

Inflation is like a monster eating away at your income and wealth, one or more bites at a time.

It is the most potential but least understood financial risk, and it takes a lot of planning and discipline to tame this monster.

While you may feel you are not taking any risk by keeping your money in the bank, your money is at inflation risk.

The only known antidote to inflation is prudent investments in assets that grow at a rate that is faster than inflation.

A word of caution, though; do not follow the financial advice shared in the animation. Do your research and if necessary, consult a financial advisor.

So this was today's task. Understand the impact of inflation on your income and wealth and the need to invest to mitigate this risk.

In the next few days, we will learn more about investing and how to get better at it.

Happy Investing.