NRI investment, Returning NRI, RNOR Income Tax

Simple Tax Guidelines for NRI Returning to India

INTRODUCTION:

As an NRI in the UAE, your biggest motivation for living and working in UAE could...

10% LTCG was re-introduced yesterday in Budget 2018 by India's Finance Minister, Mr Arun Jaitely.

According to the budget announcement, equity or mutual fund investments will be subject to a 10 percent long-term capital gains tax on profits above INR 100,000.

Long-Term Capital Gains (LTCG) on the sale of shares/stocks were exempted in 2005, making India a favorable investment arena for both Residents & NRI.

However, this tax has been reintroduced effective 1st April 2018, and this can bring in tax revenue of 50,000 crore Rupees or approximately 7.80 Billion USD.

In his budget speech on the new provisions of long-term capital gains (LTCG), Finance Minister Arun Jaitley said that

"I propose to tax such long term capital gains exceeding Rs1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31 January 2018 will be grandfathered.”

Grandfathered here means that the Capital Gains acquired on investments before 31st January are exempt from tax.

For the purpose of calculation, the stock price or the NAV of the Equity Mutual Funds held as of 31st January 2018 is the deemed purchase price of the equity/mutual fund.

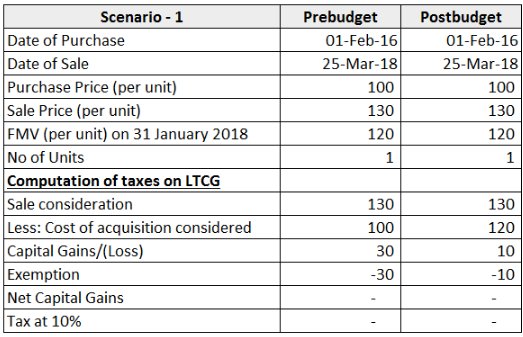

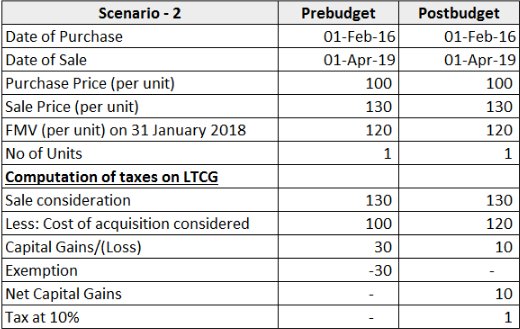

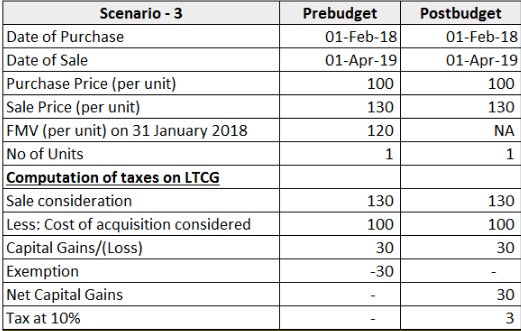

The tax calculation can be better understood with the illustration of the following scenarios;

Images Source - @entrepreneur987

Important Notes

1. Investments with profits up to INR 100,000 are exempt from paying LTCG

2. LTCG is applicable for investments held for any time period of more than 12 months.

3. An STCG or Short Term Capital Gains tax of 15% is applicable for investments held for less than 12 months.

Here is a short video of Porinju Veliyath - @porinju sharing his views on LTCG pre-budget.

Tax on LT Capital Gains in 2018? pic.twitter.com/3i3RGjoScA

— Porinju Veliyath (@porinju) December 30, 2017

Raging Bull Image Source - Vinay Bavdekar

Raging Bull Image Source - Vinay Bavdekar

The markets, as expected, did not favor this move, and the Sensex was down by 257 points yesterday and today. It is also expected to trade lower, as some investors are expected to sell to avoid a higher tax impact.

D.Muthukrishnan -

Earnings have started picking up from last quarter and structurally corporate India is expected to deliver robust growth over next few years. In the long run, only earnings matters and sentiments which are so prominent in near term dissolve.

In 2014, I shared with you a tweet of Ben Carlson.

Nice illustration of the benefits of compounding pic.twitter.com/8Ll9K3DnWy

— Ben Carlson (@awealthofcs) December 10, 2014Start with a $1 investment that doubles in value year.

1) Sell the investment at the end of the year, pay the tax and reinvest the proceeds.

Do the same thing every year for twenty years.

End up with $25,200 clear profit.

(Or)

2) Don’t sell anything.

At the end of twenty years, end up with $692,000 after-tax profit.

See the difference in long term wealth creation when there is no churning.

We advised no churning even when there was no tax on long term capital gains. It now becomes all the more important to keep the churn very minimum.

Equity as an asset class delivers superior returns over all other asset classes in the long run. This was true when there was no tax and continues to be true when there is a 10% tax.

Currently there has been no indexation benefit for LTCG on equity. This is because the cost price of previous years has implied indexing as only the price as on 31’st January 2018 would be taken from now on.

Till 2004, long capital gains from equity was taxed either a flat 10% or 20% with indexation. I would not be surprised, if in the coming years, both the options are again provided to investors.

Now that you are aware of the changes, what you need to do?

Nothing. Just continue to stay the course, as always.

Now that the Tax is proposed and most likely it will be imposed as well, I feel that we have to accept it and move on...

This should not discourage you from investing in Indian Stock Markets. However, it is wise to explore investing in India via International Mutual Funds

There are many US Dollar denominated Offshore Investment funds Investing in Indian Equity; some of the prominent funds are;

Here is a list of the top 10 Indian Mutual Funds in UAE in US $

I am Damodhar Mata, a Qualified and Independent Financial Advisor with more than 15 years of experience in the Banking & Financial Services Industry.

I am Damodhar Mata, a Qualified and Independent Financial Advisor with more than 15 years of experience in the Banking & Financial Services Industry.

To learn more about investing in Indian or other international mutual funds, arrange a free consultation with me.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

As an NRI in the UAE, your biggest motivation for living and working in UAE could...

When it comes to NRI insurance and investment, many...