30 Days Challenge

Day 22 - ETF - Just Buy the Haystack

More than USD 12,000,000,0000 are invested globally via ETFs as of 2022, which will likely cross 25...

Investing in stocks can be a great way to grow your wealth.

It also can be a quick way to erode wealth. People often wonder how a few are successful at investing in stocks, while a majority are clueless.

Here are a few useful ideas that can help you win with stock investment.

1. Instead of thinking of a stock investment as an opportunity to make a quick buck, look at it as a medium to grow long-term wealth.

You can start by investing in quality multinational companies with established business models and growth history.

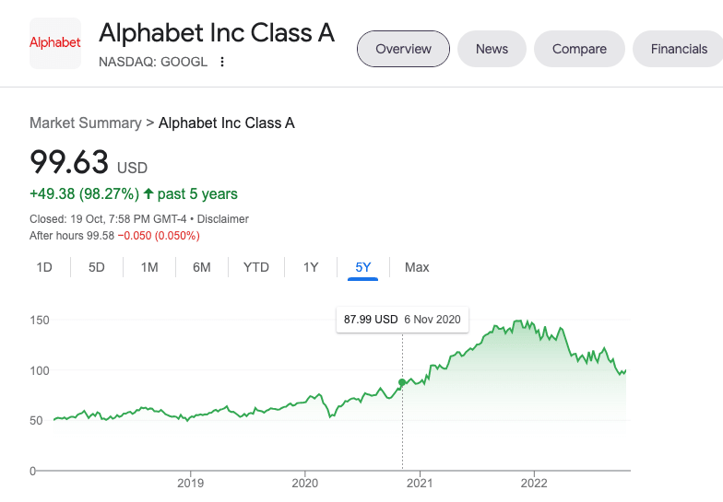

For Eg: If you buy 100 shares of Google or Apple, you become a joint owner, along with millions of other shareholders and you get to participate in the profits and losses of those companies.

The value of your investment in Google will go up or down depending on Google's share price on an exchange.

While the value of your investment may go down in the short term, stock investment can help you grow wealth in the long term.

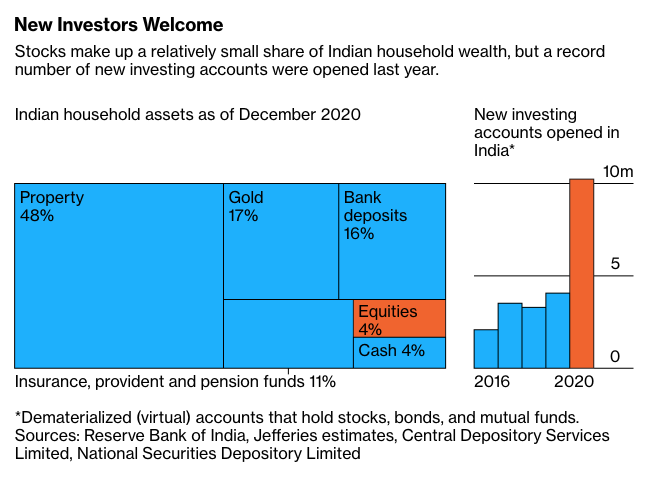

In the last year alone, millions of first-time investors started investing during the pandemic. If you are still sitting on the sidelines, wondering if you should also invest, then look no further.

With thousands of stocks to choose from, finding the right stocks to invest in can be challenging. So where do you start?

This post aims to give you a list of the top 20 stocks to invest in as a beginner.

At the outset, you might be better off investing in large multinational companies, which are market leaders in their respective fields. Such companies are also known as Blue Chip Stocks.

These companies usually are common household names and have a market cap of 10+ Billion US Dollars. They have a soundtrack record of growth and profits. They also have little or no debt on their balance sheet.

To invest in stocks in the UAE you would need a Trading account. The following are some of the trading accounts you can choose from;

Although volatile, stock market investment can help you grow wealth faster in the long run. As a beginner, it would be useful to invest in a portfolio of blue-chip stocks for stable growth and less volatility.

Even if these stocks go down in value during a correction or bear market, they tend to recover much faster than mid-cap or small-cap stocks.

As an Independent Financial Advisor, I can help you create a Holistic Financial Plan and a Robust Asset Allocation Strategy.

We can choose from a wide range of Stocks, Bonds, ETFs, and Mutual funds to suit your growth expectations and risk appetite.

I can also help you regularly review your portfolio and rebalance it when necessary.

Click the link below to arrange a free consultation and start investing in stocks.

Click here to arrange a Free Online Meeting

The above content is intended to be used and must be used for information and education purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

We would like to draw your attention to the following important investment warnings.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

More than USD 12,000,000,0000 are invested globally via ETFs as of 2022, which will likely cross 25...

-2.png?width=300&name=Day%2021-Mutual%20Fund%20Basics%20(350%20%C3%97%20250%20px)-2.png)

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.

No, not the one after the advent of Covid-19.

I am referring to the new normal amidst the tight...