critical illness insurnace

The story of Critical Illness Insurance and Have-nots!

The Story of Critical Illness Insurance.

Critical illness insurance was invented by Marius...

The US markets reversed some of its growth from the previous week, as investors digested the data showing the highest inflation in three decades.

The CPI(Consumer Price Index) reading came in at 6.2% year-over-year, the highest level since 1990, while the PPI(Producer Price Index) reading was 8.6%, the highest on record since 2010.

While some of the factors driving inflation appear to be transitionary, there are a few persistent factors like rent and wages.

Given that the inflation is continuing longer than expected, investors and policymakers are facing a double whammy;

1. Stagflation

2. High Market valuations

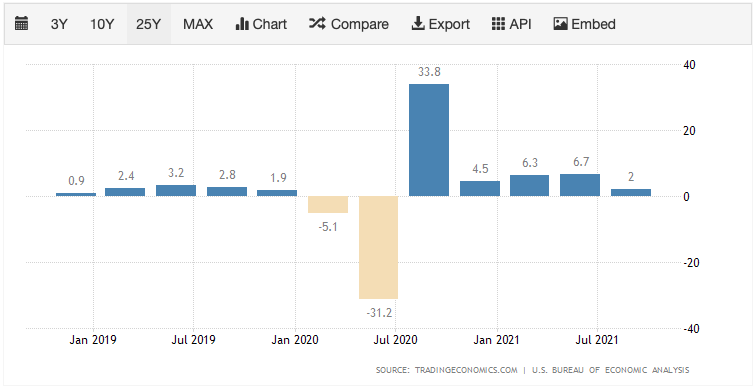

After a stellar recovery from the pandemic lows, the American economic growth was a mere 2.00% in Q3 2021. Well below market estimates of 2.7% and falling sharply 6.7% in Q2.

The Federal Reserve is now in a fix trying to contain the inflation, which it was trying to bring up for so many years. With the bond purchase tapering already on, rising interest rates is another tool the Fed can use to contain the raging inflation.

While the FED has indicated one rate hike in 2022, the market is pricing two hikes, and some are even predicting 3, based on this week’s inflation readings.

It is no secret that the market valuations are stretched and probably at a tipping point. Unless the following factors improve quickly and support the markets, a correction is not unlikely;

European equities continued to rise marginally. The Euro STOXX Index gained 0.68%. Individual country indices also rose except Italy, which was down by 0.23%.

A strong wave of Coronavirus infections is forcing European nations to consider reintroducing restrictions and lockdowns.

European and UK economies also reported slower growth in Q3 weighed down by Shortages of goods, labor, components, and rising coronavirus cases.

Chinese stocks advanced this week on speculation that the government may step in to support the ailing real estate companies on the brink of default. The large-cap CSI 300 Index rose 0.95%, and the Shanghai Composite Index added 1.4%.

Inflation is on the rise in China as well. The producer price index (PPI) increased to a greater-than-forecast 13.5% in October over a year ago, a 26-year high.

Indian equities fared well last week, with the Nifty closing above the 18000 mark and the Sensex above the 60,000 mark.

Despite the double whammy of stagflation and high valuations, the outlook for the year is still positive. However, the need for prudent portfolio diversification is more pronounced than before.

Sectors like financials, energy, and industrials tend to perform better amid rising interest rates. At the same time, industries like healthcare, consumer staples, and utilities tend to fare better when inflation is high.

Including the above sectors can provide your portfolio with a better balance and cushion the volatility.

Holding 15 - 20% cash in your portfolio to take advantage of potential corrections can also be a good idea.

Arrange a Free consultation to help you review and review your portfolio.

Although we obtain information contained in our weekly market update from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed here are my own and may change without notice. Any views or opinions expressed in the above blog post cannot be constituted as financial advice. The information in this blog post may become outdated, and we have no obligation to update it.

The information on my blog is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only, and nothing herein constitutes investment, legal, accounting, or tax advice or a recommendation to buy, sell or hold a security.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable.

We strongly advise you to discuss your investment options with your financial adviser before making any investments, including whether any investment is suitable for your specific needs.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

The Story of Critical Illness Insurance.

Critical illness insurance was invented by Marius...

Major Ailments like Cancer, Stroke or organ failure can keep a person away from work for months or...

When it comes to NRI insurance and investment, many...