Investments, Education Savings

7 easy steps to invest in the best child education savings plan in UAE

Investing in your child’s education is more than a financial goal; it’s a lifelong gift that...

College fees and associated costs are rapidly rising across the world and UAE is no exception.

In fact, UAE is one of the top 5 expensive private school fees destinations across the world.

Thanks to inflation, the price you'll pay for your children's education in the future could be significantly higher than educations costs prevailing today.

In spite of rising education costs as a parent, you may want to provide your child with the best educational opportunity to help them get ahead in life...

So how do you ensure that you save enough money for their higher education without ignoring other important aspects like saving for retirement and or for property investment etc...

The following 5 simple steps will help you save and invest for your child's education without having to ignore other aspects of your life...

Many ex-pats buy an education savings plan or investment plan impromptu, without considering its impact on other goals and the long-term impact on finances.

As a result, they are unable to achieve a balance between their overall financial goals.

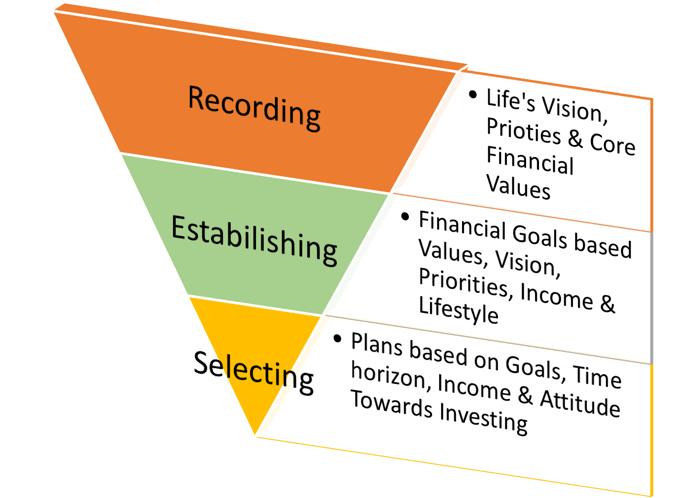

The best way to invest in any investment or insurance is the Top-Down Approach.

"Top down approach starts with the big picture. It breaks down from there into smaller segments" - Wikipedia

Using the Top-Down approach helps you determine your values, goals priorities and choose the most appropriate investment/savings.

A good financial advisor can help you;

The best and the easiest way to be able to afford to pay for your children's dreams is to start early, the earlier you start the better it is!

You should ideally start when the child is born, if you have not started to save yet, well now is the time...

Even small savings each month will translate into substantial savings later.

You can start as low as $300 or AED 1,150 per month, which will accumulate and grow into AED 502,000 in 18 years, if your investment grew at 7.00% PA

Bank deposit rates are always lower than the prevailing inflation.

Mutual funds are an ideal choice when it comes to beating inflation and diversifying risk.

A robust portfolio of International Mutual Funds can help you achieve your financial goals with desired ease.

The following quote by Les Brown says it all...

You will win if you don't quit

Investing is certainly a boring process but eventually, it is rewarding. If you are seeking excitement, then you must take your money to Las Vegas.

Staying committed throughout the investment period is an essential step towards the success of your child savings plan.

There will be periods when you would be tempted with attractive investment opportunities or the market volatility may decrease the value of your investment don't get distracted.

Markets will be volatile in the short to medium term, but in the long run they will certainly reward you with good returns.

Bear in mind that the purpose of this investment is for your child's higher education, disturbing this saving will you away from the Education Savings Goal.

While Saving & Investing for your child's higher education is important, protecting this goal from loss of income is equally important.

This ensures that your child can still afford to go to the same University you wanted him/her to go to, even though your income has stopped due to death, disability or critical illness

The following video

I am a Qualified and Independent Financial Advisor with more than 15 years of experience in Banking & Financial Services. You can arrange a Free Consultation with me to help you get the big picture, set goals, and select an ideal child education savings plan.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Investing in your child’s education is more than a financial goal; it’s a lifelong gift that...

Every parent dreams of providing the best education for their child, but in today’s world,...

The best gift you can give to your child is a quality education of their choice and...