Market Linked

Oman Insurance Smart Invest: Short Term Investment Plan

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

Investing your savings helps you build wealth. It enables you to put your money in assets that have the potential to beat inflation and earn real returns.

If you don't invest your savings, then you could be denying yourself the opportunities to enhance your wealth and achieve Financial Independence.

While investing involves a certain element of risk, it can be well managed if you follow the

As a financial advisor, I meet 3 types of people;

The pessimist believes that investing is gambling. They assume that it is risky and they are more likely to lose their savings when invested, so they stay away from it.

They continue to work for money, while it sits idle in their bank accounts.

Although the pessimists assume that they are not taking any risk by keeping their money in a bank, they are unknowingly susceptible to the following risks;

Given the increasing life expectancy, people are now living longer and spending more years in retirement than before. Running out of money during retirement could have a devastating impact on their lifestyle and family.

The second type also believes that investing is gambling.

They look at investments as an opportunity to make a quick buck but end up losing a part or whole of their savings by investing in exotic assets like Bitcoins, Forex or a similar get rich quick scheme.

Like pessimists, the impatient also are prone to the risk of not being able to achieve their goals and running short of money during retirement.

The third type is the real investor, who believes that investing is NOT gambling and they wisely invest their savings regularly in creating long-term wealth.

Unlike gambling, Investing is not supposed to be fun or exciting, it is more like cardio exercise; monotonous but very effective. It usually takes a long time for your investment to grow big enough to achieve your major financial objectives.

Nevertheless if done properly, it can make you quite wealthy. It might take you 15 -25 years to get there, however, with expert advice, you could reach your destination a little quicker and with much ease.

When discussing investments people usually ask;

How much returns will I get if I invest? or

Mutual funds in India are giving more than 20% growth PA, will I get similar returns from this fund?

Yes! You could get high returns, or you could beat a particular market for a short time, but the question is will the high returns sustain for a long time, and will such investments fit into your scheme of things.

Chasing higher returns or looking to beat a certain market may require investing in assets that are more volatile and unnecessary. Instead, it would be wise to focus on your goals and determine your "Hurdle Rate or Personal Benchmark" and select appropriate investments.

Personal Hurdle Rate is the minimum growth required to achieve your future goals; based on your current financial position, the investment horizon and some logical assumptions of future inflation and disposable income.

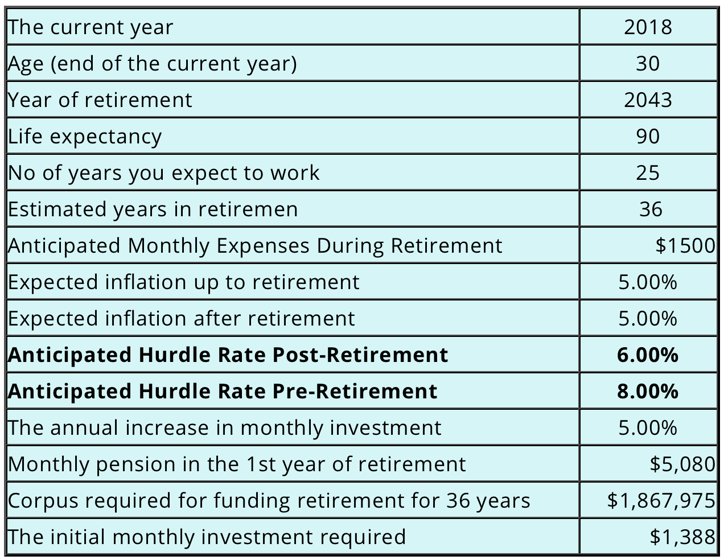

For Eg: Maddy is 30 years old Indian expat living with his family in UAE for the last 5 years. He wants to retire at age 55 in India with an income of USD 1500 in today's dollars.

He is able to set aside AED 5000 per month to build his retirement savings.

The following are table shows the logical assumptions made to determine the Personal Hurdle rate of Maddy and his Hurdle rate post and pre-retirement.

Given that Maddy's hurdle rates are 8.00% and 6.00% pre and post-retirement, Maddy now knows that he need not invest in risky assets to achieve his retirement goal.

Determining your personal hurdle rate not only helps you decide what type of assets you should invest in, but it will also help you endure bear and bull markets without taking extreme measures.

There Are No New Eras - Excesses Are Never Permanent - Bob Farell

There will always be something new and novel that evokes speculative interest among the masses. Many investors have lost their life-savings betting on these hot investment ideas throughout history.

We saw it happening with Internet Stocks in 2001, Real Estate, Energy Stocks, and Emerging markets before 2008, Bitcoins and Technology stocks in 2018. Whenever a sector is doing very well, investors become greedy and keep on investing in that sector, expecting it to grow further.

They start believing that; this time the situation is different and continue to pump huge sums of money in the hottest sector, causing it to overheat and eventually blow up.

Don't get lured into overheated investment ideas. Always remember Warren Buffet's Quote in such situations.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” - Warren Buffett

A market correction is when stock prices slightly drop from the peak. It happens when stock prices rise higher and quicker than they should have risen. When prices fall in such a manner, it corrects the market position and helps the bull market sustain for a longer period.

The major difference between a market correction and a bear market is the extent to which prices fall. A correction is when the share prices in a market have dropped around 10% and stabilize. Market corrections usually last between 3 - 90 days.

If they fall by 20% or more then it is called a Bear Market. It usually takes 3 or more months to recover from a Bear Market.

"Between 1900 and 2013, there were 123 market corrections and 32 bear markets periods. During this time, the average market correction lasted 10 months, while the average bear market lasted 15 months. Bear markets are usually shorter than bull markets, which can bode well for investors. "

Source - The Motley Fool

Like how you should not be carried away by over-heated Bull Markets, you should also not be perturbed by extended bear markets as well. It is important to stay invested and if possible buy when the valuations are cheap.

Bull Markets Make You Money, Bear Markets Make You Rich - Dividend Sensei

I’ve lost a bet. I’ve lost my keys. But I’ve never lost a decade – until now.” – Sam Stovall, S&P’s chief strategist

The decade between January 2000 and December 2009 is sadly recollected by economists and investors as the lost decade.

If you had invested in S&P 500 index funds during the lost decade your investment would have lost at least 39.9% value after adjusting inflation.

During the same period if you would have invested $1,000 in gold its value would have quadrupled to$4,000.

Or if you had invested in Emerging Market Bonds you would have earned almost 10% PA returns on your investment.

Even investing in conservative US Government Bonds would have doubled in value.

Image Source: http://www.waypointwp.com

Image Source: http://www.waypointwp.com

Diversifying your investments in various asset classes depending on your goals and investment horizon can help you preserve capital and earn a steady return on your portfolio.

Also Read: How to Invest in UAE, using 3 Bucket Investment Approach?

The 5 Rules for Successful Investing can be summarised as follows;

As a qualified and independent financial advisor, I can help you define your goals, determine your Personal Hurdle rate and build a diversified portfolio to achieve your financial objectives.

Arrange a Free Consultation to understand how we can work together.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

Steve Cutts has a Youtube channel with only 12 videos in 9 years but has more than 1.2 million...

Idikhar Plus is a Sharia-compliant regular savings plan from Salama.