Life Insurance, Zurich Futura

Zurich Futura insurance With Enhanced Living Benefits

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

Are you looking to get the most out of your Zurich Futura plan?

Effectively managing your policy's performance is key to the sustainability of your plan for the "Whole Life".

In this post , I will break down the essential steps to enhance your zurich futura fund performance. I'll cover everything from choosing the right rate of return to understanding the benefits of Dollar-Cost Averaging, and how regular reviews can keep your plan on track.

Whether you're looking to buy a new policy or looking to optimize your existing plan, this article provides practical tips and expert advice to help you make informed decisions.

Discover how to balance your protection needs with your budget, and learn how to adjust your plan to suit your changing financial goals.

Many policy holders assume that the fund performance only affects the cash surrender value of the plan. This is far from reality.

Actually, the fund performance is a key aspect of this plan it impacts both the cash value and how long the plan sustains the benefits you have chosen.

Your policy will sustain for "Whole Life" only if the investment grows at the rate selected on the illustration.

Also the cash surrender value will only available when you surrender the benefits of the plan.

Zurich Futura is a unit-linked insurance plan.

It aims to provide a cover for Whole Life, where the premium payment term could be for 10, 15, 20 or more years. The premiums after charges are allocated in investment funds to grow in value.

The cost of insurance is deducted from your account value of your plan.

Although, Zurich Futura is made to withstand intermittent market volatility; the cover could cease; if the account value became zero due to nonpayment of premiums or due to adverse market conditions or inefficient fund selection or management.

Having said that, this can be avoided by managing your plan effectively.

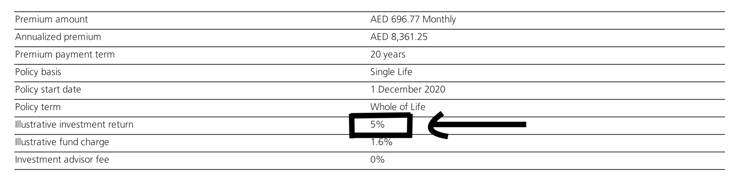

The first step is choosing an appropriate rate of return, in line with your risk appetite; while calculating the premiums. Discuss with your financial advisor the impact of investing at a higher or lower rate on your cash value or sustainability of the plan.

An ideal range is between 5% - 7%.

Your premiums will go up if you choose a lower growth rate and vice versa.

Ask your adviser to show you different options with a lower /higher rate of return and premium payment terms.

Don't just settle with the options provided by your advisor.

Spend some time to understand how the plan works and engage in customizing your plan to suit your needs and cash flows.

If you already have a Futura plan, you can still restructure it to suit your protection needs and risk appetite.

Obtain online access to your plan. Now they're all an app available. Download the app to have easy access to your account.

Click here to register your online account and monitor your policy

Monitor your Zurich Futura Fund Performance on half yearly or yearly basis, and discuss with your advisor if the fund performance is not up to the mark.

Zurich fund center is a repository of all the necessary information about various funds available to invest within the Futura plan.

You can find a lot of useful information and fund factsheets when you access the Fund Centre. Learn how to use it.

You can select the funds that align with your risk appetie and the growth rate selected on your illustration.

Reading this article can help you build a robust investment portfolio on the Futura; Mutual funds in UAE – How to build a robust portfolio?

Once the plan is set up, proactive management of the investment funds is essential. Talk to your advisor on a regular basis and review your plan at least once a year, if not more.

Bench mark the performance of the plan with your illustration to determine if it is on track.

It helps you to understand if the growth is in line with the projections and make necessary amendments to the investment strategy.

If your advisor is not helpful; please find one who can manage your plan effectively.

Understand the concept of Dollar Cost Averaging and use it to your benefit, with the help of your financial advisor.

The following video will explain DCA

When the markets go down, they for sure will. Don't panic and make hasty decisions. Analyze the situation carefully, it can also be an opportunity to continue investing in a particular market/fund.

The more you learn and apply the best investment principles better your Futura plan will perform. It will also help you wisely invest for your other financial goals like retirement, children's education, etc..

If you feel overwhelmed with the investment process, don't hesitate to seek expert help.

I manage a portfolio of more than 300 Futura plans, and I have helped many ex-pats restructure their Futura in line with their protection needs and budget. I can help you as well.

You can arrange a Free Initial Meeting with me to help you analyze, amend and effectively manage your plan.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

.png?width=300&name=Zurich%E2%80%99s%202025%20Claims%20Report%20(350%20x%20250%20px).png)

When a father doesn’t come home one evening...Or a mother’s heart suddenly stops without warning......

Zurich Futura: A Premier Whole Life Insurance in the UAE