Weekly Market Update

Weekly Market Update - The Bullish Stance!

With earnings season in full swing, the markets maintained their bullish stance last week. The US...

Discover the remarkable growth of India's stock market as it surpasses the $4 trillion mark and sets new records.

India's stock market has experienced remarkable growth, surpassing the $4 trillion milestone on Tuesday, 5th December 2023. This achievement is a testament to the country's robust economic growth and investor confidence.

It is a historic moment for the Indian equity market, and here's a dive into what this means and how it happened.

Image Source: https://www.thehindubusinessline.com/markets/bulls-take-bse-market-cap-to-new-high-of-403-trillion/article67587247.ece

Image Source: https://www.thehindubusinessline.com/markets/bulls-take-bse-market-cap-to-new-high-of-403-trillion/article67587247.ece

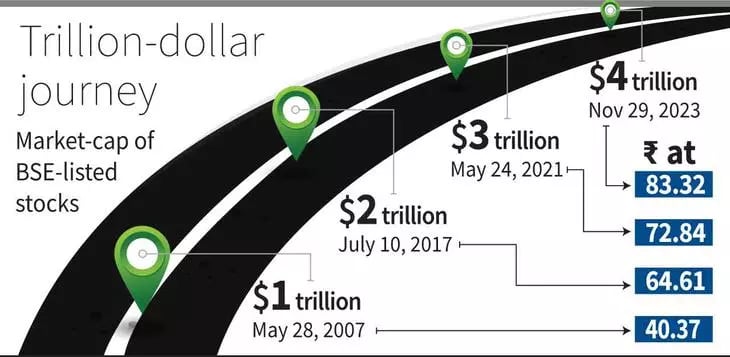

The BSE market cap has been steadily climbing over the last few years. Reaching 1 trillion in 2007, $2 trillion in 2017 and $3 trillion in 2021. The journey from $3 trillion to $4 trillion took just two-and-a-half years, a rapid ascent by any standard.

India is now in fifth place in the global rankings, behind the US, China, Japan, and Hong Kong.

So, what's fueling this rally?

Two big factors: corporate earnings have been robust, and there's been a significant drop in crude oil prices. These elements have given investors more confidence to dive into the market.

One of the stars of this growth story is the rise in midcap and smallcap stocks. These smaller companies have been showing some serious dynamism and risk appetite, significantly fueling the market's overall growth.

But let's not forget the backdrop here: the Indian economy's resilience. Amidst a world of economic ups and downs, India's strong economic indicators and adaptive policies have laid a solid foundation, encouraging investors to bet big on the market.

The market's also getting a boost from domestic liquidity, with plenty of funds flowing in. However, foreign fund inflows have seen some fluctuations due to high US bond yields.

The declining dollar index is making India, an emerging market, even more attractive to investors. When the dollar weakens, investors often look for opportunities elsewhere, and India's market is ripe for the picking.

Additionally, the government's focus on economic reforms and ease of doing business has attracted foreign investments and boosted investor confidence. Initiatives such as Goods and Services Tax (GST), Insolvency and Bankruptcy Code (IBC), and liberalization of foreign direct investment (FDI) have created a favorable environment for businesses and investors. These reforms have improved transparency, reduced regulatory hurdles, and enhanced the overall investment climate.

In summary, the surge in valuation of India's stock market can be attributed to factors such as strong economic growth, technological advancements, favorable demographics, and government reforms. These factors have created a conducive environment for investors and propelled the Indian stock market to new heights.

The remarkable growth of India's stock market and its surpassing of the $4 trillion milestone have significant implications for the Indian economy. Firstly, it reflects the strength and resilience of the country's economic fundamentals. The stock market serves as a reflection of investor sentiment and confidence in the Indian economy. The surge in market capitalization indicates that investors are optimistic about the growth potential and stability of Indian companies.

The rise of the stock market also has positive implications for the overall investment climate in India. It attracts foreign direct investment (FDI) and promotes domestic investments. The increased market capitalization provides companies with access to capital for expansion and growth. This, in turn, boosts job creation, innovation, and economic development. The stock market acts as a catalyst for economic growth and prosperity.

Moreover, the stock market's performance has a ripple effect on other sectors of the economy. As stock prices rise, it increases household wealth and consumer confidence. This leads to higher consumption, benefiting various industries and contributing to economic growth. The stock market also plays a vital role in the financial sector, providing opportunities for financial institutions, brokers, and other market participants.

However, it is important to note that the stock market's performance is not solely indicative of the overall health of the Indian economy. While it is a significant component, other factors such as employment, inflation, and fiscal policies also impact the country's economic well-being. Therefore, policymakers need to consider a holistic approach when formulating strategies to ensure sustainable and inclusive economic growth.

In conclusion, the growth of India's stock market has positive implications for the Indian economy, attracting investments, promoting economic development, and benefiting various sectors. However, it is crucial to maintain a balanced perspective and address other economic indicators to ensure long-term sustainable growth.

Looking ahead, India's stock market presents exciting prospects and potential opportunities for investors. The country's strong economic fundamentals, favorable demographics, and government reforms provide a solid foundation for sustained growth. The stock market is expected to continue its upward trajectory, albeit with periodic corrections and fluctuations.

One of the potential opportunities lies in sectors such as technology, healthcare, renewable energy, and infrastructure. These sectors are expected to experience significant growth and offer attractive investment prospects. The government's focus on initiatives like Digital India, healthcare reforms, and infrastructure development further enhances the potential returns in these sectors.

Moreover, India's stock market provides opportunities for long-term investors who can identify quality companies with strong fundamentals. Investing in well-managed companies with a competitive edge and sustainable business models can generate substantial returns over time. It is important to conduct thorough research, diversify investments, and adopt a disciplined investment approach.

Furthermore, the increasing integration of technology in various sectors presents opportunities for disruptive innovation and new business models. Investors who can identify and capitalize on these trends can benefit from the growth potential of the Indian economy.

In conclusion, India's stock market offers a promising future with potential opportunities in sectors driven by technology, healthcare, renewable energy, and infrastructure. By staying informed, conducting thorough research, and adopting a long-term perspective, investors can unlock the potential of India's stock market and participate in its growth story.

Are you Investing in Indian equities to participate and benefit from the growth story?

Or are you keen to explore how to invest in Indian Equities?

Share your thoughts and insights on this exciting opportunity!

Also, you can arrange a Complimentary Discovery Call to discuss.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

With earnings season in full swing, the markets maintained their bullish stance last week. The US...

The Shifting Landscape of Emerging Markets

The much anticipated Fed meeting failed to provide any direction on the potential tapering this...