Best Life Insurance In UAE: Your Guide To Financial Security

Life is unpredictable, but your family's financial security doesn't have to be.

The right life insurance plan ensures that your loved ones are financially protected. By adding essential riders, you can receive a cash lump sum in case of death, disability, or critical illness—effectively replacing lost income and securing your future

This guide will help you understand everything you need to know about life insurance in the UAE, from types and benefits to how to choose the right plan.

Quick Links

What is Life Insurance?

Life insurance is a financial safety net. It’s a contract between you and an insurance company, where the insurer guarantees a lump sum payout to your beneficiaries in the unfortunate event of your passing. It ensures that your loved ones are not left financially vulnerable and can maintain their lifestyle even when you're no longer there to provide for them.

However, life insurance isn’t just about death benefits—it’s also a powerful tool for income protection. With the right riders, such as critical illness and disability insurance, you can secure a financial safety net while you're still alive, ensuring you and your family remain financially stable if you are unable to work due to a medical condition or accident.

Types of Life Insurance in the UAE

-

Term Life Insurance: Provides coverage for a specific period. If the insured passes away during this term, beneficiaries receive the death benefit. It's straightforward and often the most affordable option.

-

Whole Life Insurance: Goes much beyond the term insurance. It provides Whole-life coverage. In addition to life cover, it also includes investment, accumulating a cash value over the life of the plan.

-

Endowment Plans: Combine insurance and savings, providing a guaranteed sum of money on maturity or upon death. These plans are ideal for risk averse investors seeking moderate returns.

- Universal Life Insurance: Offers High Value Permanent Life Insurance on Guaranteed or Indexed basis with downside risk protection. Ideal for legacy planning, key person insurance, and creating generational wealth.

-

Life Takaful Plans: Takaful, derived from the Arabic word for "solidarity," is a Sharia-compliant cooperative insurance system where participants contribute to a common fund to mutually guarantee each other against loss or damage. Life Takaful plans address the protection needs of individuals conscious of their religious beliefs and seeking a halal way of safeguarding their family's financial future.

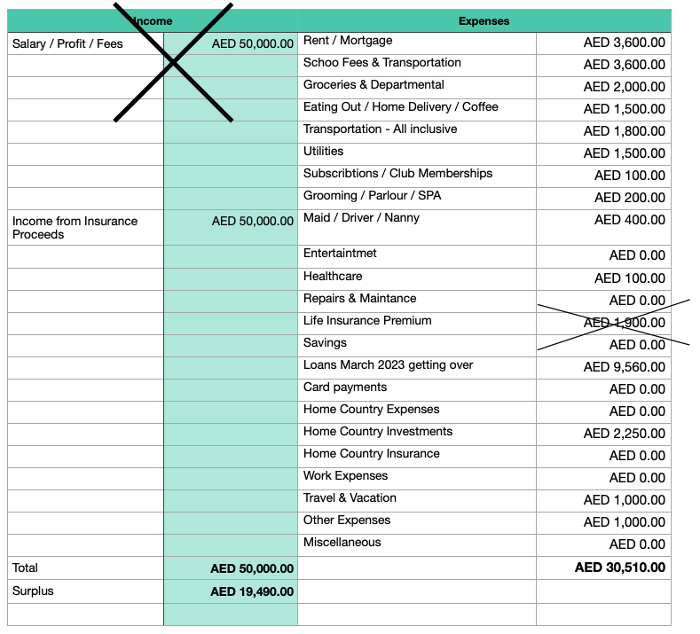

How Life Insurance Replaces Lost Income & Secures Your Future

Why Protect Your Income?

✔️ Life Insurance: Ensures your loved ones continue to receive financial support if you pass away.

✔️ Critical Illness Insurance: Provides a lump sum payout if you suffer a serious health condition that prevents you from working.

✔️ Disability Insurance: Acts as income replacement if an accident or illness leaves you unable to earn.✅ The right life insurance policy secures your financial future and protects your family from unexpected financial shocks.

Why Buy Life Insurance in UAE?

Life insurance in the UAE is designed with expats in mind, providing tailored solutions to meet the diverse needs of over 190 nationalities. Even Non residents can buy Life Insurance in Dubai.

Here’s why you should consider it:

-

Affordable Premiums: Competitive rates for a wide range of policies catering to diverse protection needs.

-

International Coverage: Provides global protection, ensuring peace of mind whether you’re traveling or relocating.

-

Comprehensive Cover: Includes death benefits, critical illness cover, accidental death, disability coverage, terminal illness benefits, and optional riders for enhanced security.

-

Choice of Currencies: Premiums and payouts in USD, AED, GBP, EUR, and more, ideal for expats with international financial commitments.

-

Hassle-Free Claims and International Settlement: Streamlined claims process with minimal documentation, ensuring beneficiaries can file and receive claims from anywhere.

-

Easy Online Access: Manage policies, pay premiums, track claims, and access documents conveniently through digital platforms.

-

Tax-Free Payouts: Beneficiaries receive payouts tax-free, maximizing the financial benefit.

-

Flexible Payments: Pay premiums monthly, quarterly, semi-annually, or annually to match your cash flow.

-

Portability: Retain coverage even if you relocate, making it ideal for expats with dynamic careers.

Life insurance in the UAE offers unmatched flexibility, global reach, and comprehensive protection for expats and residents alike.

What are the benefits of Life Insurance in UAE

- Replace Lost Income - When you die your income stops but many expenses except the life insurance premiums continue. Your life insurance policy will replace your income to support the lifestyle of your loved ones.

-

Debt Protection: Prevent unpaid loans or mortgages from burdening loved ones.

-

Future Goals: Secure your child’s education, marriage, and other key financial goals.

-

To Cover Repatriation Expenses: As an expat, life insurance can help your family manage the costs of repatriation in the event of your passing, ensuring they can return to their home country and begin a new chapter with financial stability.

-

Leave a legacy - It is the most affordable way to build a large legacy

-

Estate Equalization - It can help you divide the assets among your heirs without having to break them down or sell them.

-

Add on Living Benefits - You can buy many living benefits like critical illness cover, disability benefits, etc along with your life insurance in Dubai.

-

If you are from a country that levies an estate tax, Life insurance can help your heir fund the estate tax to claim your assets.

-

As Keyman insurance to ensure your business continuity

-

To establish a corpus for a charity, if you support a charitable cause

How to buy the best life insurance in UAE?

Life insurance is a simple yet effective way to protect your family’s financial future. Here are the steps to buying the best life insurance;

-

Assess your Protection Needs: Work with an independent financial advisor to determine your protection needs. You can also use this calculator to get a fair idea.

-

Determine the cover basis : Cover basis Single Life, Joint Life - First Death, Joint Life Last Death or Joint Life both Death - This is one of the most crucial steps.

-

Choose a Plan: Select a policy that suits your needs—whether it’s term insurance, whole life, endowment, or universal life insurance. The life insurance companies in the UAE offer a wide range of options to cater to different requirements and budgets.

-

Add Riders: Enhance the scope of your policy with riders like critical illness cover, disability benefits, or a waiver of premium for comprehensive protection.

-

Apply for Coverage: Complete the application process and provide accurate information about your health, lifestyle, and financial situation.

-

Complete Medical Tests: Many insurers require a medical examination to assess your health before underwriting the policy.

-

Underwriting: The insurance company evaluates your application and medical reports to determine the terms and cost of your coverage.

-

Pay the Initial Premium: Once approved, pay the first premium to activate your policy.

-

Policy Issuance: Your policy is issued, and the coverage begins, giving your loved ones the financial security they deserve.

-

Review Your Protection Needs Annually: Life circumstances change over time—whether it’s a new addition to the family, a career change, or a major financial milestone. Review your life insurance coverage every year to ensure it remains adequate for your evolving needs.

By following these steps, you ensure a seamless process and secure comprehensive protection for your family’s financial future.

Benefits of Buying Life Insurance Through – Damodhar Mata - Financial Advisor in Dubai

Benefits of Buying Life Insurance Through – Damodhar Mata - Financial Advisor in Dubai

-

Highly Reviewed

-

I’m proud to have earned the trust of clients across the UAE with my personalized service and expertise. My goal is to deliver value-driven solutions that truly make a difference in people’s lives.

-

-

Personalised Guidance

-

I provide one-on-one consultations to thoroughly understand your protection needs.

-

My advice is always tailored to your financial goals and budget, ensuring you choose a policy that aligns perfectly with your unique circumstances.

-

-

Unbiased Advice

-

As an independent financial advisor, I work with all the leading insurance providers in the UAE.

-

This means I can offer you unbiased recommendations, clearly explaining the pros and cons of each policy so you can make the best choice for your family.

-

-

Claims Assistance

-

I’m here to guide you through the claims process, ensuring everything is handled smoothly and efficiently.

-

My focus is to make sure your claims are settled promptly, so you can focus on what matters most during difficult times.

-

Let’s work together to secure the best life insurance plan for you and your loved ones. Contact me today to start the journey toward long-term financial security and peace of mind.

Click here to book a Discovery Call

Frequently Asked Questions

How Much Life Insurance Do I Need?

Life insurance aims to replace the potential loss of income in the event of death. To help you calculate your life and critical illness cover:

- Use Our Calculator: Click here to access a simple calculator that provides a fair idea.

- One-on-One Consultation: I offer a detailed calculator to assess specific needs, including:

- Your family's lifestyle

- Mortgage or other liabilities

- Schooling and higher education expenses for children

- Marriage or other financial goals

- Support for aging parents

- And the impact of inflation

Did you know? Only 12% of critical illness claims and 39% of life cover claims paid were over $200,000 (Source: Zurich Claims Paid Report 2024).

$200,000 is often insufficient for a family to maintain their lifestyle or meet long-term goals. Make sure to estimate your protection needs efficiently and secure adequate coverage to safeguard your loved ones.

Which is the Best Insurance in the UAE?

The best life insurance depends on factors like your age, nationality, coverage needs, health conditions, and family medical history.

As an Independent Financial Advisor, I work with leading insurance companies in the UAE to provide unbiased advice and find the best plan for you.

Can I Hold More Than One Life Insurance Policy?

Yes, you can have multiple policies, provided you declare your existing plans to the insurer when applying for a new one.

What Happens if I Miss a Premium Payment?

Most insurers offer a grace period of 60–90 days to pay your premium. After this period, the policy may lapse, and you’ll need to meet reinstatement conditions. Some policies allow you to make them "paid-up," offering reduced coverage temporarily. Always check your policy terms and conditions for specific details.

Where Can I Get the Claim Settlement Statistics of Life Insurance Companies in the UAE?

Claim settlement statistics are published by top insurers like: Zurich International Life, MetLife, Friends Provident

Click here for Zurich Middle East Claim Statistics.

How Long Should My Life Insurance Policy Last?

Your policy duration should match your financial responsibilities.

For instance:

- Cover your working years to protect against loss of income

- Align with significant milestones, such as paying off a mortgage or funding your children’s education.

- Ideal term insurance cover is between 20-25 years, beyond which it starts losing it cost advantage. if you are young and or looking for longer cover term, you should consider Whole Life Insurance.

What is the Best Age to Buy Life Insurance?

Now is always the best time to buy life insurance if you don’t already have it. Life insurance provides critical protection for your family, and it’s never too late to secure that peace of mind.

That said, buying in your 20s or 30s offers significant advantages:

Secures Lower Premiums: Younger applicants benefit from more affordable rates.

Provides Long-Term Coverage: Lock in comprehensive protection at a lower cost.

Ensures Benefits While in Good Health: Easier approval and lower costs when you’re younger and healthier.

Even if you already have coverage, it’s always the right time to reassess your protection needs and consider topping up your policy to match your current financial responsibilities.

What is the Free Look period?

Life Insurance companies in UAE typically provide a free look period of 15-30 days. During this period if you change your mind, you can cancel the policy and get a refund of the premiums you paid.

Can non residents get life insurance in UAE?

Yes, Non residents can get life insurance in UAE, subject to medical underwriting and other regulations.

Who can be the beneficiaries on my Life Insurance?

You can appoint any one with legal and justifiable insurable interest as your beneficiary. Residents typically appoint their family members like Spouse, Children, Siblings, Parents as beneficiaries.

You can also appoint your business, business partners, Trusts, charitable organisations and lenders as beneficiaries.