Why Many High‑Income Earners Live Paycheck to Paycheck, Even in the UAE!

Earning a high income would guarantee financial comfort.

Myth or Fact?

I have met people earning AED 75,000+ per month and still feel broke. While a few earning AED 18-20K a month and are quietly building wealth, security, and legacy.

And it’s far more common than most people realise:

- 53% of UAE residents say they struggle to meet monthly expenses. – Source

- 48% of Americans earning over $100K live paycheck to paycheck. – Source

- 1 in 3 earning $200K+ say they have “more month than money.” – Source

Based on this, it certainly feels more like a myth than a guarantee.

What does living paycheck to paycheck actually mean?

Living paycheck to paycheck means your monthly income is fully consumed by your expenses, and if that income stopped, even briefly, you would struggle to cover your financial obligations.

- There’s little or no savings, so no wealth building.

- There’s no meaningful buffer for emergencies.

- And any disruption; a job loss, a delayed bonus, an unexpected bill creates immediate pressure.

In other words:

Your lifestyle depends entirely on your next month’s salary!

And this can happen at AED 10K a month or AED 100K a month.

The income changes. The vulnerability doesn’t.

Here’s the truth:

A big paycheck can improve your lifestyle, but only a solid system can improve your life.

I am not saying that all high earners struggle, some are doing very well. But many do and the reasons are predictable, structural, and fixable.

Let’s break down the four biggest reasons high‑income earners feel broke, especially in high‑cost cities like Dubai.

1. Cash‑Flow Leaks: The Silent Drain

For most high earners, It is rarely a single large expense that causes strain. More often, it’s the combination of many small commitments that gradually dry out the cash flow.

It is the “I earn well, I don’t need to track this” mindset.

Small leaks add up:

- subscription creep

- impulsive upgrades

- lifestyle add‑ons

- convenience spending

- “it’s only AED 200” decisions

Individually harmless. Collectively destructive.

The real issue isn’t income, it is the lack of a working system. Without which, even a strong salary feels tight.

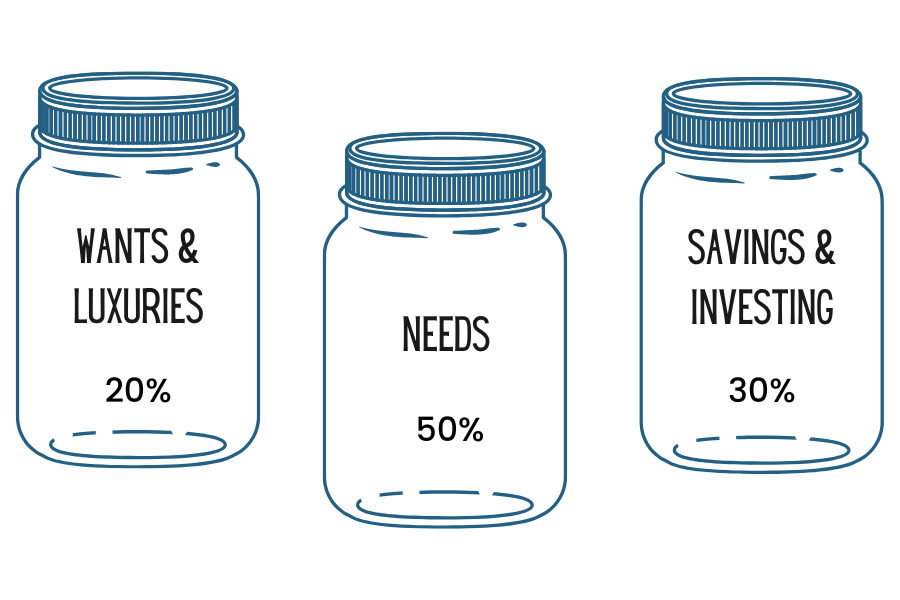

A simple structure like the Expat Advantage Budget (EAB) helps you understand;

- what’s essential

- what’s optional

- what’s leaking

- what’s actually moving you toward wealth

Visibility builds awareness. And awareness enables disciplined, intentional wealth accumulation.

2. Heavy Fixed Costs: The Real Budget Killers in the UAE

High earners don’t overspend on coffee. But their fixed expenses are typically high.

And the usual suspects are;

- rent / mortgage

- school fees

- car loans

- long‑term lifestyle upgrades

Once these are locked in, they consume income before the month even begins.

This is why two families earning the same salary can have completely different outcomes.

One builds wealth. The other feels trapped.

Ask yourself:

- Am I upgrading my lifestyle faster than I’m growing my net worth?

- Do my fixed costs give me freedom, or tie me down?

This is where a financial advisor in Dubai becomes invaluable, not for products, but for perspective.

3. No Emergency Fund: High Income ≠ Financial Safety

A high salary doesn’t protect you from shocks:

- job loss

- business slowdown

- medical emergencies

- family obligations

- market downturns

Without a buffer, even wealthy families fall into debt quickly.

Think of a buffer like your financial runway:

- It gives you lift‑off confidence when things go well.

- It gives you a safe landing when life gets turbulent.

High‑income earners live paycheck to paycheck because they lack an emergency fund.

Ask yourself:

- Could I cover six months of expenses without borrowing a dirham?

- Are my savings liquid and accessible?

Most high earners don’t fail because of income. They fail because they have no shock absorbers.

4. No Financial Plan or Values Alignment: Money Without Direction

Here’s a truth most high earners overlook:

Money without direction always disappears.

A high income creates options, but without a written plan or clear financial goals, those options turn into distractions:

- lifestyle upgrades

- impulsive decisions

- comparison‑driven spending

- inconsistent saving

- no long‑term structure

This is why many high‑income earners feel broke even when the numbers look impressive. Their spending isn’t guided by values or goals, it’s guided by noise.

A written plan changes everything. It gives your money a job.

With clear goals, you know:

- what you’re working toward

- what to prioritise

- what to ignore

- what to automate

- what to stop doing

When spending aligns with values and goals, wealth compounds with purpose. When it doesn’t, wealth evaporates quietly.

Ask yourself:

- Do I have written financial goals for the next 1, 5, and 10 years

- Do I know my target savings rate

- Am I buying freedom, or just buying more stuff

A plan doesn’t restrict you. It liberates you; because it gives every dirham a purpose.

The Shift High Earners Need

Not just more income, but also more clarity. More structure. More intention.

If you want to see what this looks like in your own life, we can map it out together.

We’ll break down your numbers, your goals, and the exact steps to move from:

Paycheck‑to‑paycheck → Financially Secure → Wealth‑building → Legacy‑focused

Your income gives you potential. Your system turns that potential into freedom.