Investments, Index Funds

What is an index fund & why should you invest in it?

Don't look for the needle in the haystack. Just buy the haystack! - John C Bogle

"Do not put all your eggs in one basket."

We have heard this before, haven't we?

When we do so, we carry the risk of breaking all the eggs if the basket is dropped.

Image Source: https://markarmstrongillustration.com/911/

Asset Allocation in layman terms is not putting all your eggs in one basket.

Similarly, when it comes to investing, it is recommended that you don't invest all our savings in one particular asset class.

The process of diversifying our investment in different asset classes in line with your investment goals, horizon and risk appetite is called asset allocation.

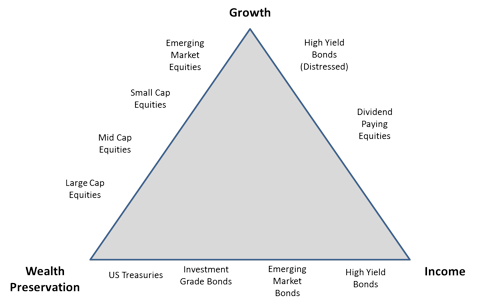

An asset class can be compared to a basket of similar flowers or fruits. It refers to a group of investments with similar characteristics.

For Eg: Cash, Savings Account, Fixed Deposit or Recurring deposits are typically grouped into one asset class called "Cash". The aspect of liquidity is the common character of all the assets in this basket/asset class.

Stocks, Bonds, Real Estate, Commodities(Gold, Silver) and Cash are some examples of asset classes.

A balanced diet is essential for the well being of a person. The carbs provide the energy to the body, proteins build the muscles, and the calcium keeps the bones strong etc.,

Too many carbs can make the person fat. Too much of proteins can make digestion difficult, while too much fat can clog up the arteries.

Too many carbs can make the person fat. Too much of proteins can make digestion difficult, while too much fat can clog up the arteries.

A balanced diet is consuming appropriate quantities of different food groups needed to provide energy, maintain health and promote growth.

When it comes to investing, an ideal allocation of different assets provides a balance to your investment portfolio.

Every asset class in a portfolio has a distinct nature and specific purpose. They may also react differently to a particular market situation.

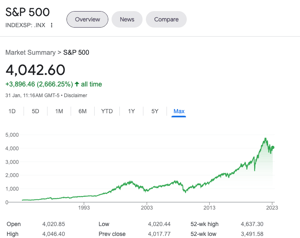

The stocks or Equity funds can help you grow wealth in the long term; however, they are very prone to the ups and downs of the market in the short run.

While bond prices are typically stable, the returns they offer in the long run may not beat inflation.

Real estate can provide both capital appreciation and income raising with inflation, but it can be very illiquid.

Keeping your savings in Cash or Term Deposits can provide safety and liquidity. Still, it will remain exposed to the inflation risk.

https://seekingalpha.com/article/884451-how-to-use-reits-within-your-portfolio-reit-investing-101

Efficient Asset Allocation can help you build a robust investment portfolio to grow wealth and protect capital. It is an essential aspect of Holistic Financial Planning.

What about your portfolio?

Is it balanced?

Are you using the right asset classes to grow wealth and mitigate market risks?

How often do you review your investment portfolio to rebalance it in line with market fluctuations?

Arrange a Free Online Consultation for an Unbiased Review of your portfolio.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Don't look for the needle in the haystack. Just buy the haystack! - John C Bogle

-2.png?width=300&name=Day%2021-Mutual%20Fund%20Basics%20(350%20%C3%97%20250%20px)-2.png)

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.