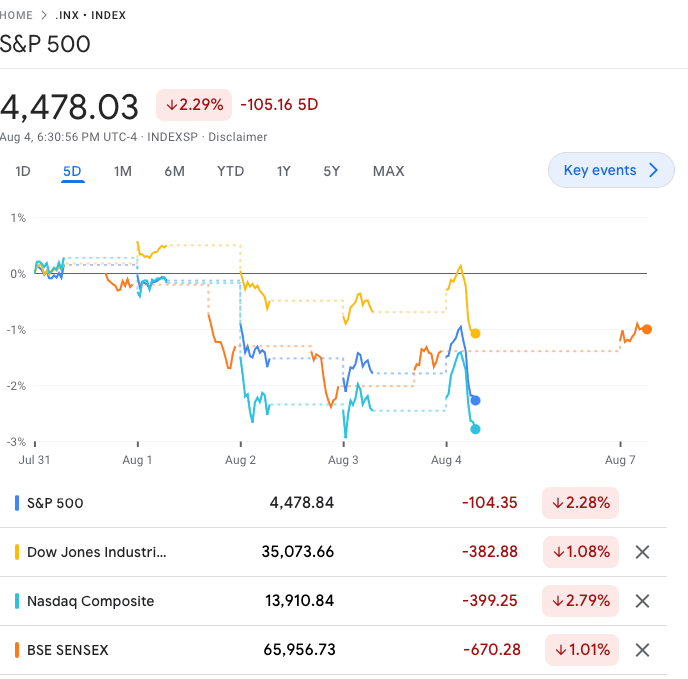

After robust growth in July, global equities declined in the first week of August.

The negative sentiment was primarily driven by the downgrade of U.S. government debt from the highest level, AAA, to AA+ by Fitch. This is the second downgrade of U.S. government debt since 2011, when S&P downgraded it to AA+.

However, many experts and seasoned investors believe the downgrade will unlikely disrupt the U.S. economy and markets.

USA

U.S. stocks had a rough last week, with major indexes closing in the red on Friday. The S&P 500 and Nasdaq experienced their worst week since March 2023.

The Index heavyweights Amazon and Apple reported their earnings on Thursday.

Amazon's earnings beat market expectations thanks to the strong growth in its core retail business. The stock rallied more than 9% at Friday's open.

Meanwhile, Apple was down by about 3% after a mixed report showing weak iPhone sales and strength in its services business.

Europe and U.K.

The BoE raised its key interest rate for the 14th time in a row, by 25 basis points to 5.25%. This is the highest rate in the last 15 years. It also warned that the rates could stay high until the inflation target of 2.00% is achieved.

U.K. house prices fell by 3.8%(YOY) in July, after a 3.5% drop in June. This is the fastest decline since July 2009

Annual inflation in the euro area slowed to 5.3% in July from 5.5% in June but remained well above the European Central Bank's 2% target.

Inflation also declined in Germany and France, the bloc's two largest economies.

Asia

Chinese stocks were up as the government took a supportive stance to offset concerns of disappointing economic data. The Shanghai Stock Exchange Index gained 0.37%, while the CSI 300 advanced 0.7%.

Despite robust economic data Indian Equity was also down for the second week in response to global trends.

Here is net week's update.