Weekly Market Update - 15-08-2023

After a dismal 2022, global equity markets witnessed a spectacular rally in the first half of the...

This is the weekly market update as of 10th January 2022. Tune in every week for news, views, and market moves.

In this episode, we will discuss the market moves in the first week of the year, investors’ exodus towards value stocks, and the outlook for the month.

In this episode, we will discuss the market moves in the first week of the year, investors’ exodus towards value stocks, and the outlook for the month.

The new year started with a bang as shares of Tesla, AMD, Nvidia, Ford, and Apple pushed higher. However, global equities led by the US were on the back foot by the end of the week.

The S&P 500 was down by 1.87%, and the Nasdaq was down by 4.53%, while the Dow was marginally down by 0.29%.

The markets retreated sharply in response to surging Treasury yields and the hawkish tone of the FOMC meeting minutes. The mid-December meeting minutes revealed a potential increase in the pace and frequency of interest rate hikes during the year. They also indicated that the Fed is considering a contraction of its balance sheet in addition to the acceleration of tapering.

The above actions of the Fed, aim at easing inflation by reducing the liquidity in the markets, but they also put pressure on growth stocks, particularly those with high valuations.

Europe

European equities were also down with worries of tapering and interest rate hikes, as Central banks strive to contain persistent inflation. The Euro Stoxx index was down by 0.32%, while the UK's FTSE was up by 1.36%, led by value stocks.

China

With the ongoing turmoil in the real estate sector and the hawkish tone of the Fed, Chinese stocks were in the red. The CSI 300 Index fell by 2.3%, and the Shanghai Composite Index was down by 1.7%

India

Despite weak global cues, Indian equities posted robust gains last week. The Sensex was up by 2.56%, settling at 59,744.65, and the Nifty gained 2.64% to settle at 17,812.70.

Outlook

As the interest rates are set to increase, and the liquidity is drying up faster than expected, a rotation towards value stocks will continue swiftly.

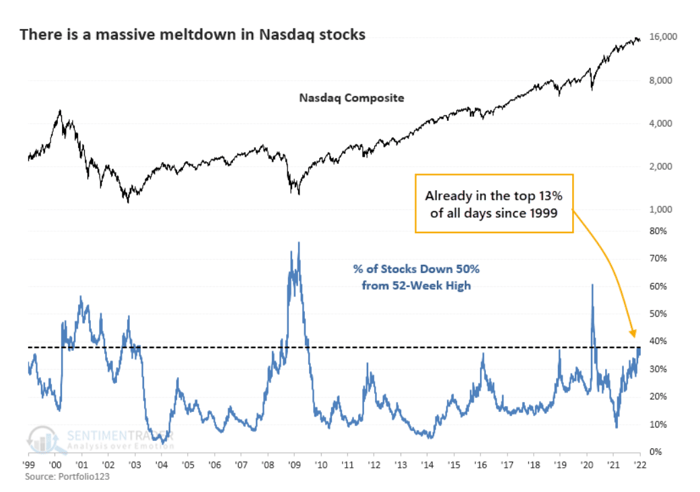

Such a shift is already evident, with almost 40% of the Nasdaq stocks losing more than 50% of their value from their respective 52-week highs. -SentimentTrader.com

With the Nasdaq down by close to 7.00% from its all-time high of 16057.44, we could see some buying opportunity if this correction continues.

Having said that, it is crucial to have a diversified portfolio of growth and value stocks, blend with bonds, cash, and gold to ride out the volatility during the year.

Also, with the earning season around the corner, we could see a tussle between bulls and bears throughout January and beyond.

This was a weekly market update as of 10th January 2022. I hope you found it valuable and engaging.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2-2.png?width=300&name=WEEKLY%20MARKET%20UPDATE%20-%2014th%20August%202023%20(350%20%C3%97%20250%20px)-2-2.png)

After a dismal 2022, global equity markets witnessed a spectacular rally in the first half of the...

This is the weekly market update as of 19th December 2021. Please visit every week for news, views,...

While we in the UAE had our long EID break last week, the Global markets were on a roller coaster...