Medical Insurance

Medical Insurance for Dependent Parents and Senior Citizens in Dubai/UAE

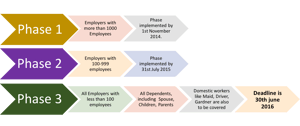

Medical Insurance for Dependent Parents in Dubai, is now mandatory according to the DHA Health...

This post highlights the important features of AXA Medical Insurance and the Top 7 reasons to choose AXA Medical Insurance in Dubai

The AXA Group is the largest insurer in the world serving more than 102 million clients across the globe.

The AXA Group is the largest insurer in the world serving more than 102 million clients across the globe.

AXA in GCC has been operating for more than 60 years, hence is a widely accepted brand both within and outside UAE.

In Dubai AXA gulf offers DHA regulations complaint insurance plans.

These plans cover residents having a Dubai visa living in Dubai and Northern Emirates. It also covers treatment in Abu Dhabi, provided they are not residing there.

For those who have Abu Dhabi visa or are residing in Abu Dhabi, they must avail HAAD - Health Authority of Abu Dhabi regulated insurance plans.

The 7 Plans of Health Perfect Series are primarily classified on the Geography of coverage as follows;

International Coverage |

|

|

Health Perfect 1 is the top of the range plan, offering global medical coverage providing access to premium hospitals for both inpatient and out patient treatment. |

Health Perfect 2 and 3 offer worldwide coverage excluding USA, providing access to premium hospitals for both inpatient and out patient treatment |

Regional Cover |

|

Health Perfect 4 and 5 offers coverage in A.G.C.C: Arabian Gulf Co-operation Council member countries being Saudi Arabia, Kuwait, Bahrain, Qatar, UAE, Oman and Jordan, plus Iran, Lebanon, Syria, Egypt, Tunisia, Morocco, Algeria, India, Pakistan, Sri Lanka, Bangladesh, Korea, the Philippines, Indonesia, Nepal & Bhutan The HP4 & 5 provide access to a Premium hospitals and clinics for both Inpatient and Out-patient treatment |

Local Cover |

|

Health Perfect 6 and 7 are ideal for those who do not travel extensively outside their country of residence. You can choose UAE and Oman plus any one of India, India, Pakistan, Sri Lanka, Bangladesh, the Philippines, Nepal & Bhutan being your home country The HP6 provides access to a standard clinics and economy hospitals for outpatient benefits, however it provides access to premium hospitals like Welcare for Inpatient treatment. |

Based on the type of coverage required, You can choose from the 7 Health Perfect plan to suit your Budget.

The Health Perfect Series Plan offer international standard health insurance at affordable premiums including the following features;

The following table shows the maximum Maternity cover possible in a policy year;

Plan |

Cover |

|---|---|

| Health Perfect 1 | AED 50,000 |

| Health Perfect 2 | AED 40,000 |

| Health Perfect 3 | AED 25,000 |

| Health Perfect 4 | AED 25,000 |

| Health Perfect 5 | AED 15,000 |

| Health Perfect 6 | AED 15,000 |

| Health Perfect 7 | AED 10,000 |

All Health Perfect Plans offer a free Personal Accident cover, providing a cash lump sum in case of accidental death of the insured.

Worldwide emergency medical assistance is available on International and Regional Plans including emergency evacuation and repatriation 24 hours a day, 365 days a year.

For all out of network claims, just log on to AXA Claims, to submit your claims from the comfort of your home.

The following video explains in detail the online claim process;

All in all, AXA Medical Insurance plans offer value for money, especially the regional and local plans offer the best coverage options at attractive premium rates.

The HP6 plan in particular offers a great value for money, as it provides inpatient access to premium hospitals like Welcare, City Hospital, Saudi German Hospital, Canadian Specialist Hospital & Al Zahra, and it also offers Maternity cover up-to AED 15,000 PA

What do you think? Was this information useful, Share your views by dropping a line or two in the comments section....

Are you happy with your current medical insurance provider, or is your insurance due for renewal, let's have a quick chat about your medical insurance needs to help you buy the most suitable Medical insurance in Dubai.

Schedule a Free 15 minutes discovery call to understand more about Medical insurance in UAE and to help you choose the best cover

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Medical Insurance for Dependent Parents in Dubai, is now mandatory according to the DHA Health...

The post provides a list of Medical Insurance companies in Dubai.

The Health Insurance Law of Dubai No 11 of 2013 makes it mandatory for all Residents of Dubai to...