DEWA IPO, IPO

Is DEWA IPO a good Investment?

In the last few days, many clients, friends, and colleagues have reached out to know if the DEWA...

With tech stocks soaring and the NASDAQ hitting record highs each week, it's easy to point fingers in that direction.

Why wouldn't tech companies come out of this as the winners?

Their dynamics are unique: such stocks benefit in a physically integrated society (the old normal) and even more so in a virtual one (the new normal). Through more significant use of social media, video communications and ad-filled platforms, tech fundamentals are improving in both paradigms, and investors naturally gravitate toward such optimistic futures.

The big question mark arises when we think about how overheated tech stocks have become. To coin Ray Dalio's phrase, the amount of cash being piled into tech is now "reflected in the price", suggesting a fair share of volatility ahead as investors debate whether there's room for any more upside or not.

This opens the opportunity for cash to move away from tech and into new areas; a sister sector catches our eye.

Here's why we should focus on specific versions of healthcare stocks as the next big thing post-COVID-19.

A Bank of America survey cited medical improvements as the biggest factor affecting the stock market going forward: with over 68% of investment managers employing this as their primary signal.

When we match this level of investor focus with the overarching demand for healthcare at the moment, an exciting effect takes the form: momentum.

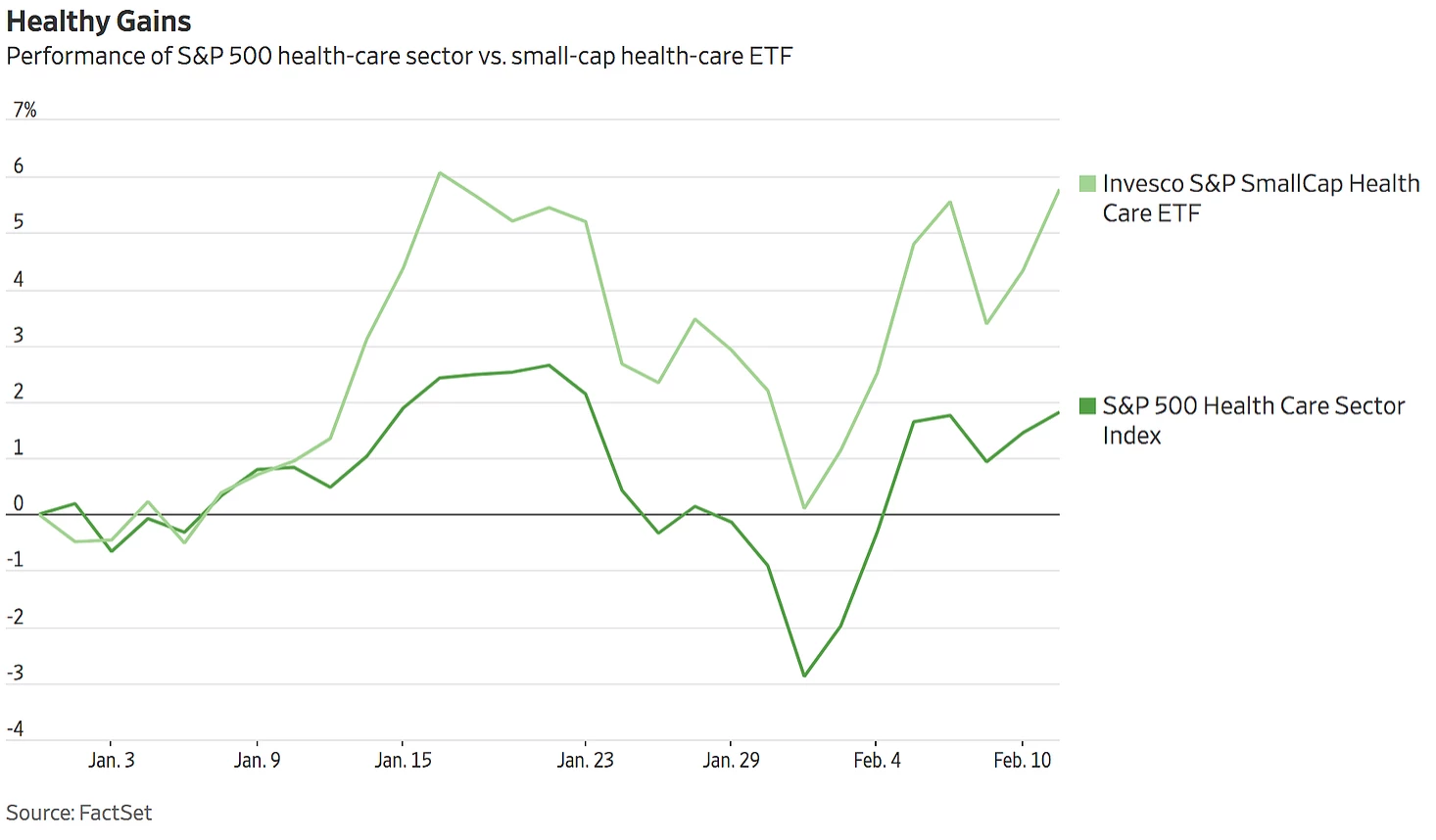

Figure 1: Healthcare stocks outperform the market (S&P500); slightly behind the tech

Healthcare stocks now have momentum behind them as a) investors look at the medical sector to mend our COVID difficulty and b) the societal shift towards safer living promotes healthcare post-crisis too.

"Sectors likely to outperform this year are not the usual cyclicals and financials, but rather those that will continue to generate value and sustained growth (momentum) beyond the current shock — sectors like IT and healthcare." - Stéphane Monier, CIO at Lombard Odier

This is our first point of attraction from an investing perspective, as we know that momentum can move stock prices quicker than expected and keep them up there longer than expected.

In other words, strong healthcare demand coupled with positive momentum can give medical stocks a robust, sustained run upwards: and we investors should catch that rise before things get too pricey.

Relative to the rest of the market, the current performance of specifically small-cap healthcare stocks - companies worth between $100 million and $2 billion - is condign.

Figure 2: Small-cap healthcare beats this year (trend continues as of June 2020)

This subset of the healthcare market has overpowered most others due to the following;

a. They are not vulnerable to heavy political regulation (as pressure is focused on the large manufacturers instead)

b. They tend to move in a relatively elastic manner (if the industry goes up 5%, small-caps move up more-than-proportionately, perhaps around 10% due to their riskiness).

But are they the risky ones right now? Initially, perhaps.

Looking a little closer, perhaps not.

While the small-cap trade would usually strike a chord with beginner investors - the stocks are too risky, too unpredictable and lack the finance to survive - the narrative has changed.

"Small-cap health care has been the place to be so far in 2020 and will remain so. They are less likely to be in the crosshairs of any Presidential political debate and more likely to benefit from propelled growth." - Nicholas Colas, DataTrek Research

In an environment that currently relies on the development of healthcare but restricts large corporations with regulations, small-cap healthcare stocks grasp the autobahn of both worlds: claiming high-reward (from the demand for medical progress) and simultaneously low risk (from less legal pressure).

Lucrative opportunities have now been narrowed down to the healthcare sector and then even more so, to small-cap stocks within the former. But we started this article with the dominance of tech...what happens there?

Consumer demand for more efficient/accurate diagnosis along with the new stay-at-home paradigm calls for a marriage between healthcare and technology: in other words, a divisive way to increase the speed of detection AND provide medical advice remotely.

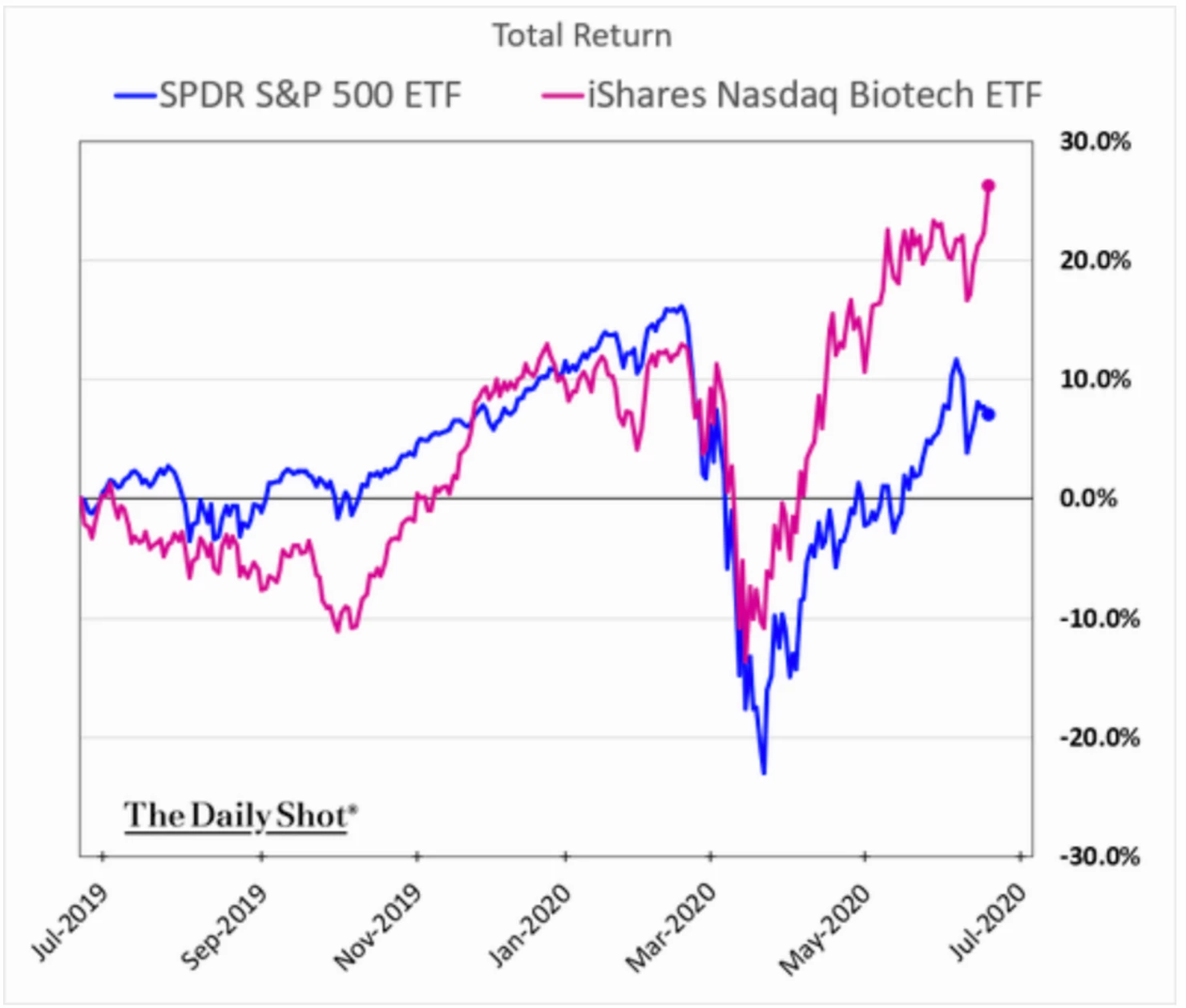

Figure 3: Biotech shares have substantially outperformed the market this year

Source: (Wall Street Journal, 2020)

The love child between healthcare and tech created a bubble that soared through the mid-2010's: a biotech rally that saw some stocks churn over 300% returns in a single year. While the bull-run was appreciated at the time - money-filled memories for some, painful ones for those who cashed out too early - there was rarely a strong, fundamental basis for such rises to happen.

There is now.

A near-future of health-cautious economies and remote doctor appointments is likely to fuel the growth of companies that can provide safe, sustainable, and unprecedented products in a new normal. Retail investors - such as you and I - can leverage this trend to find growth opportunities at reasonable prices, keeping in mind the "demon" part of our analogy when doing so.

"While biotech is one of the best performing industries of recent months, low analyst coverage coupled with high valuations and unproven growth can usher short (betting against) interest in specific companies." - Paraphrased from Bloomberg Quint

The notion that biotech’s still suffer from volatility and are sometimes difficult to judge in terms of growth brings about two key considerations:

a) We have to be careful about the names being chosen (target more established small-cap biotech's with good fundamentals). If investors are looking for more risk, however:

b) Deploy only a small amount of capital in the more volatile companies. In doing so, beginner investors lay claim on the upside (benefiting enormously when these biotech names go up) but are protected on the downside (risking only a small amount of cash if the stock capsizes).

Although the love-child parts of healthcare and technology are highly desirable, the demon part can't be ignored.

With a market that remains uncertain ahead of earnings season, small-cap biotech stocks seem like the best bet for navigating both the current and post-COVID paradigms, leaving only one question:

Who are your winners in the post-crisis world?

This article was first published on my personal blog https://www.thedividendpayout.com/.It is posted here for the benefit of the larger audience. However this cannot be constituted as Investment Advice. Please discuss with your financial advisor for expert and personalized advice on your investments.

Saahil Menon is an undergraduate student at the London School of Economics and chief content writer of his blog, The Dividend Payout. Through his financial columns - featured on his website, Gulf News and various other outlets - he aims to simplify finance for teenagers and encourage them to begin investing during their youth. His internship experience with the Abu Dhabi government and Lazard’s investment banking division has also expanded the scope of his articles: allowing both a local and global perspective on current market affairs.

In the last few days, many clients, friends, and colleagues have reached out to know if the DEWA...

While most relatives would think a hundred times before asking you for money, a few may approach...

-2.png?width=300&name=Day%2020-Shares%2c%20Stocks%20and%20Equity%20(350%20%C3%97%20250%20px)-2.png)

Would you invest in a Pirate Stock Exchange?