Who let the bears out?

Weekly Market Update

Last week, the bears were out, busy pushing down the growth assets and scaring the bulls away to safe havens. However, the most critical questions now are,

1. Who let the bears out?

-

- Was it the advent of the Omicron variant?

- Was it the hawkish tone of the Fed?

- Or was it the year-end portfolio rebalancing and liquidating for dividend payment by mutual fund houses?

2. Will the sell-off continue, or will the markets recover before shortly?

Who let the bears out?

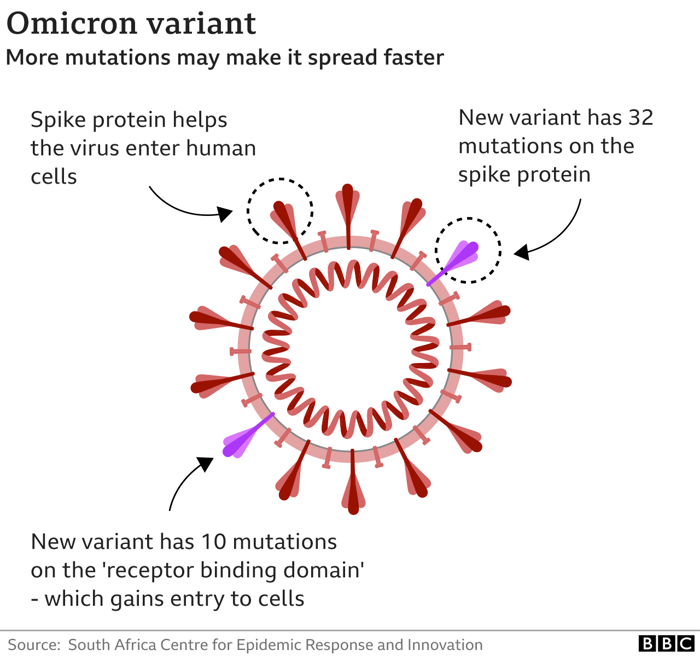

The markets were on tenterhooks, even before the advent of the Omicron variant. Since then, there has been quite a debate on its impact on the economy, causing panic and market volatility. However, health officials indicate that vaccines could provide some protection, particularly when it comes to severe illness and hospitalizations.

"We are better positioned to defend against Omicron than we would have been earlier in the pandemic." - Eric Topol, MD - Professor of molecular medicine and executive vice-president of Scripps Research. Click here to read the detailed report.

Given the strong jobs report and growing US economy, the FED's tone has become more hawkish of late, indicating a swifter tapering. In the last week's commentary, the Fed dropped the word transitionary when describing the inflation in the US. This also added some fuel to the fire. However, in light is the recent setback, a rise in interest rates in 2022 is doubtful.

Lastly, the year-end liquidation and rotation by mutual fund houses also contributed significantly to the fall in stock prices. Typically mutual funds rebalance their portfolios before the year-end by trimming overweight winning positions to buy underweight and relatively cheaper or losing positions. Given the above-average returns on many growth stocks, rebalancing effects are more pronounced this year-end.

So, it is difficult to attribute one particular event to last week's market correction. It was more of a medley of sorts like stretched valuations, the Omicron variant threat, the hawkish fed tone, and the year-end rotation and rebalancing by active fund managers.

Given the above, the more important question is...

Will the sell-off continue, or will the markets recover shortly?

The chances of a quick recovery are based on the reports of the virulence of the new variant and the efficacy of the vaccines and treatments against it.

If the new variant proves to be less potent, this dip could be an opportunity to buy. Even otherwise, experts believe that the global recovery can only be delayed and not derailed.

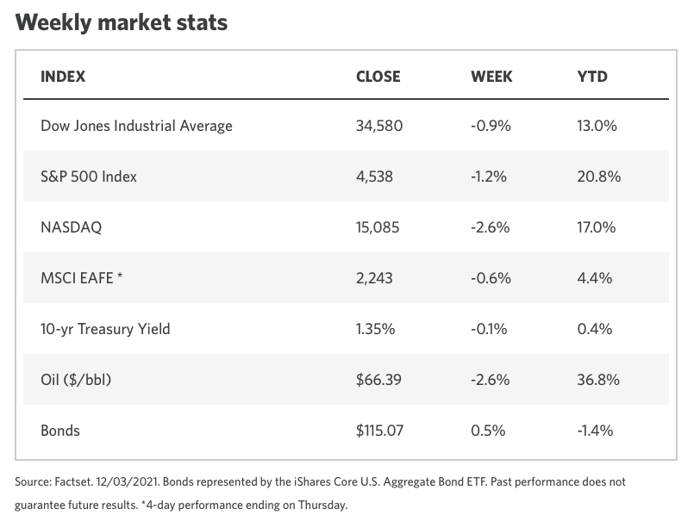

Despite the current market uncertainty, overall, 2021 has been a good year, with the S&P 500 growing by more than 20% YTD.

Diversification and portfolio rebalancing are paramount to lock in the profits built over the year.

Whether it is Holistic Financial Planning, Life Insurance, or Investing to grow your wealth, whatever your needs are, I am here to help.

Arrange a Free Online Meeting to discuss your objectives and explore potential solutions.

Click here to Arrange Online Meeting

Disclaimer

Although we obtain information contained in our weekly market update from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed here are my own and may change without notice. Any views or opinions expressed in the above blog post cannot be constituted as financial advice. The information in this blog post may become outdated, and we have no obligation to update it.

The information on my blog is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only, and nothing herein constitutes investment, legal, accounting, or tax advice or a recommendation to buy, sell or hold a security.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were or will be profitable.

We strongly advise you to discuss your investment options with your financial adviser before making any investments, including whether any investment is suitable for your specific needs.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...