Investment, Stock Market, Sustainable Energy

Is now a good time to invest in the sustainable energy sector?

Steve Cutts has a Youtube channel with only 12 videos in 9 years but has more than 1.2 million...

How will you invest when the bull market ends?

The present bull market has been raging for more than a decade and has reached dizzying heights in the last few years.

Although the market looks strong with more than adequate liquidity, inflation fears are slowly creeping in, and the valuations are looking stretched.

"It's only when the tide goes out that you learn who's been swimming naked." ― Warren E. Buffett

While the Fed and other governments are doing their best to keep the markets up, fundamentals will catch up sooner than later.

In the last few years, you could be successful at investing in stocks, even with little or no proficiency, but how do you invest when the bull run ends?

Educating yourself with the fundamental principles of investing and the basics of economics and applying them is the only way to remain successful at investing during and after the bull run.

Here are some basic concepts of stock market investing

Growth and value are two basic strategies in Stock / ETF / Mutual Funds Investing. Unfortunately, even seasoned investors are often confused between growth stocks and value stocks.

Growth stocks are typically shares of companies with a very high potential for growth in revenue and profits. They tend to outperform the broad market, particularly in the short to medium term. The PE ratio of such stocks is usually high in recognition of the potential manifold growth of the company

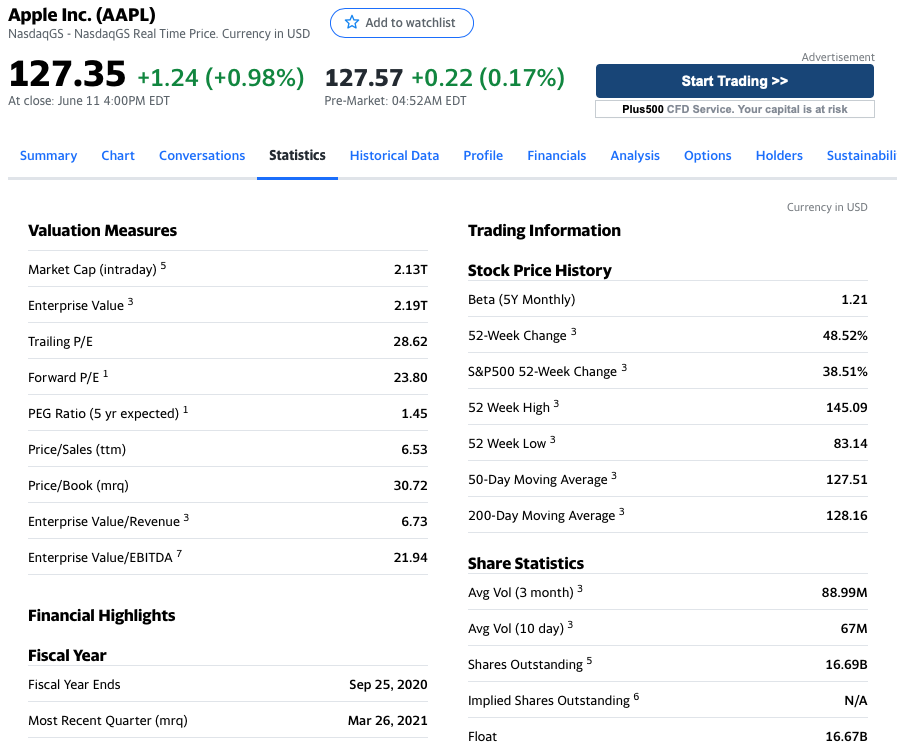

P/E ratio = Market value per share / Earnings per share

The PE ratio(price-to-earnings ratio) measures the price you will pay for a share; relative to the company's annual income (Earnings). In other words, it helps you understand how much you will pay for each $1 of a company's earning. For Eg: If a company's P/E ratio is 20, you are paying $20 for $1 of profit per share.

A higher P/E ratio means that you will pay more for each unit of net income, and a lower PE ratio means you will pay less.

But it is not always so simple. Sometimes when the PE is low, it also means that the stock is not in demand or the company is not likely to do well in future, so it is crucial to consider other factors before investing.

The average P/E ratio for stocks is typically around 20 - 25, which means that the investors are willing to pay $20-$25 for each dollar of the company's profits.

However, with certain industries like eCommerce, technology, Software, Fintech, Biotechnology, Aerospace and Defense, the PE ratios are typically high, >50.

There are also industries where that average tends to be lower, <20. For Eg: Banking & Financial Services, Air Transport, Utilities, etc...

PE ratio can be used to measure the valuation of an individual stock like Apple or an index like S&P 500 or Nifty.

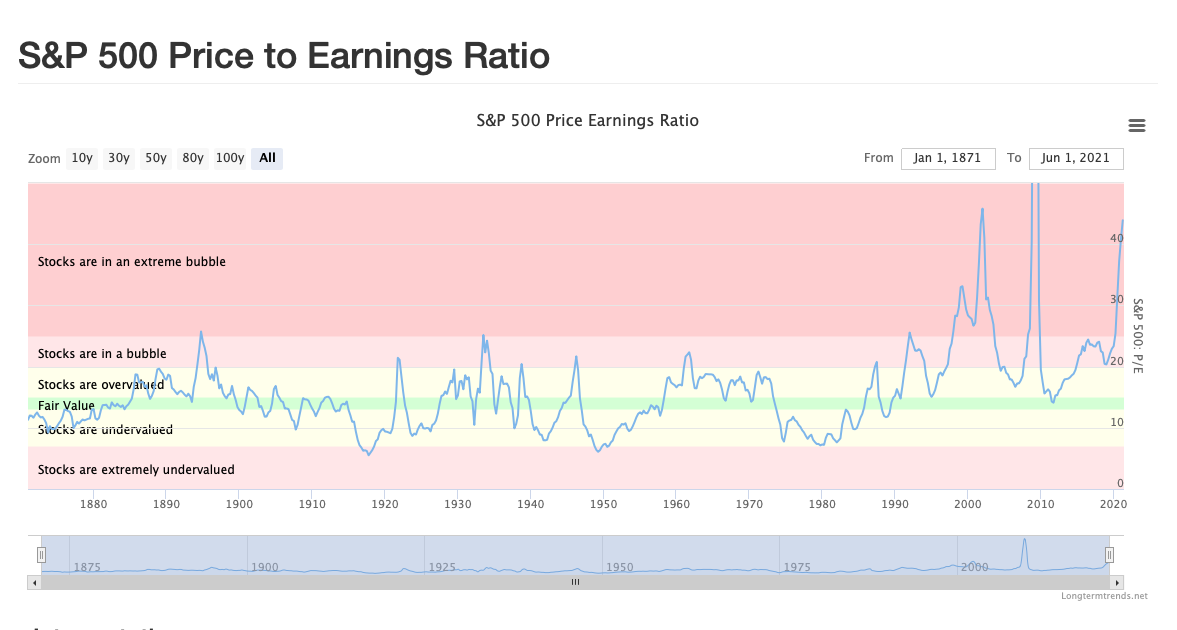

The following is the PE Ratio chart of S&P 500 since 1871

Source: https://www.longtermtrends.net/sp500-price-earnings-shiller-pe-ratio/

Source: https://www.longtermtrends.net/sp500-price-earnings-shiller-pe-ratio/

When you look up for PE ratio of a stock, you will see two types of PE ratios;

Sometimes, growth stocks may seem expensive and overvalued, so investors look for good companies at a bargain. Such a company's stocks are known as Value Stocks. They typically trade at a lower price relative to their intrinsic value and fundamentals( Revenue, Earning, and Dividends)

Despite having solid fundamentals, some stocks fall out of investors' favor or get affected due to an economic cycle or an adverse industry event, so they trade at lower prices. Such stocks are known as value stocks because they offer a good value for the money invested.

Investors buy these stocks hoping that the share prices will rise in the future when the broader market recognizes their full potential.

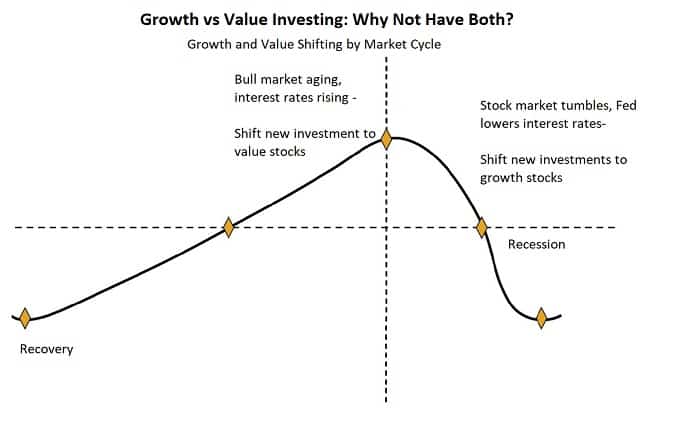

While both growth and value investing are good investment strategies, the one you should go for depends on your financial goals, investing knowledge, preferences and market conditions.

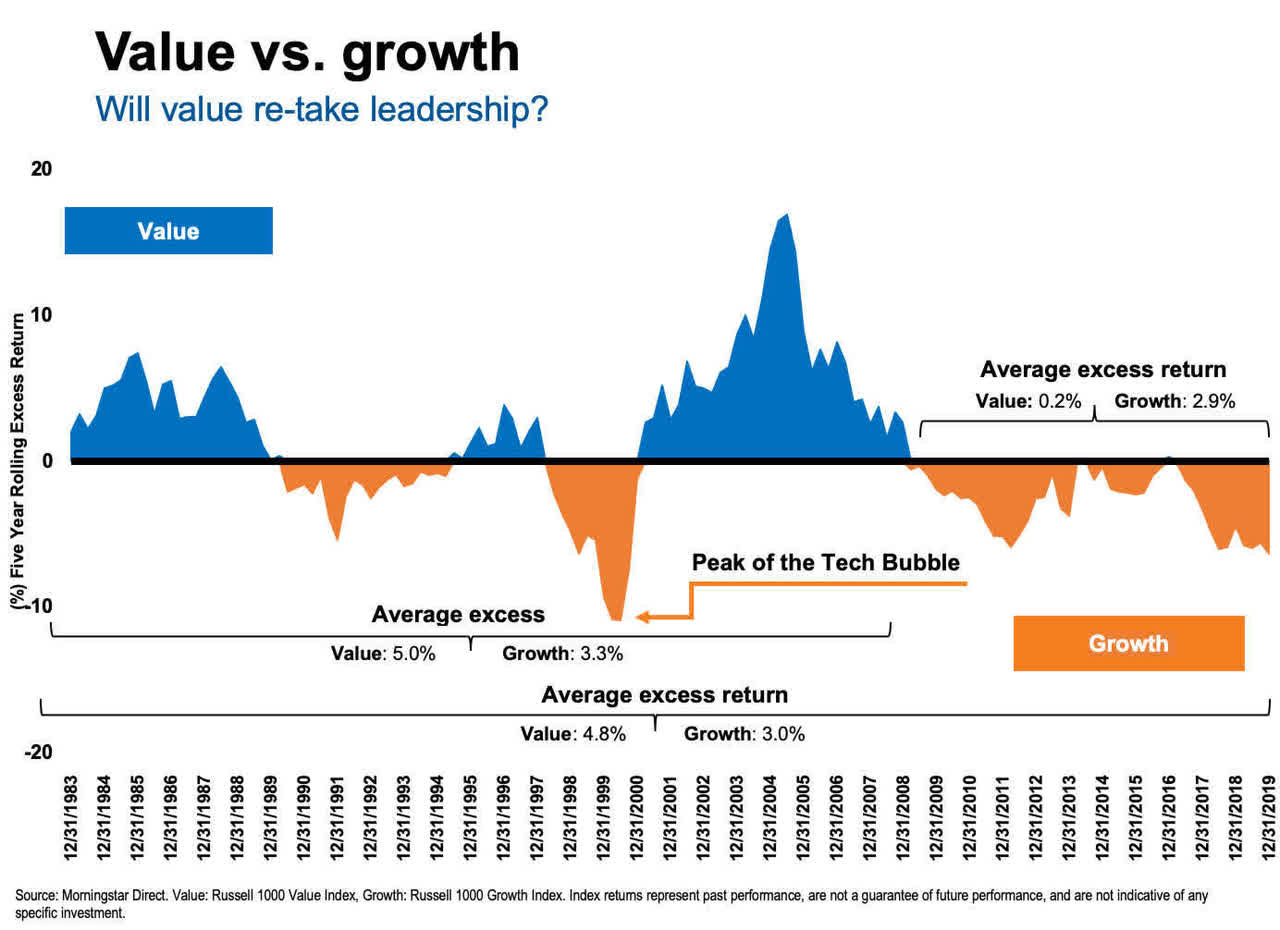

Historically, Growth stocks tend to fare well when interest rates are low and company earnings rise. However, they also tend to fall first when the markets are correcting.

https://mystockmarketbasics.com/growth-vs-value-investing-2018/

https://mystockmarketbasics.com/growth-vs-value-investing-2018/

Value stocks generally lag behind growth stocks in a bull market, but they tend to fare better during periods of higher interest rates and inflation. With the pent-up demand continuous government stimulus, higher inflation, and interest rates are more likely in the next 2 - 3 years.

On the other hand, growth stocks may also continue to do well because of excess liquidity and rising earnings.

Given the unclear market signals, it would be better to invest in a diversified portfolio of growth and value stocks with Bonds, Gold, and Cash to hedge against inflation and market corrections.

Also, now is an excellent time to review and rebalance your portfolio to book profits and scale down your portfolio risk.

As an Independent Financial Advisor, I can help you create a Holistic Financial Plan and a Robust Asset Allocation Strategy.

We can choose from a wide range of Growth/Value Stocks, ETFs, and Mutual funds to suit your growth expectations and risk appetite.

I can also help you regularly review your portfolio and rebalance when necessary.

Click the link below to arrange a free consultation and start investing in stocks.

About Damodhar Mata

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

The above content is intended to be used and must be used for information and education purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

We would like to draw your attention to the following important investment warnings.

1. https://www.merrilledge.com/article/growth-vs-value-investing-two-approaches-to-stocks

2. https://www.fool.com/investing/stock-market/types-of-stocks/growth-stocks/value-vs-growth-stocks/

3. https://seekingalpha.com/article/4409732-pondering-growth-versus-value-stocks-investing-question

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Steve Cutts has a Youtube channel with only 12 videos in 9 years but has more than 1.2 million...

Robust portfolio management has two essential processes.

"Life finds a way." - Dr Ian Malcolm (Jeff Goldblum) - Jurassic Park

"Life finds a Way". It always...