Weekly Market Update

Sturm and Drang! - Weekly Market Udpate

Sturm and Drang are perhaps the right words to describe the prevailing global market situation.

Despite a litany of strategies that could help navigate this stock market, retail investors are still a little sceptical about the tools they should use.

Some conventional theories have been useful in this crisis – using technical indicators to judge momentum and focusing on political warfare (US-China) to predict overall sentiment. In contrast, many others have been proven grossly inaccurate.

Namely, the method of using the economy to predict stock market has drawn considerable debate: should the former be used to drive decisions against the latter?

At face value, maybe. Looking a little harder, perhaps not.

While inextricably linked, the first thing that blurs the line between economies and asset prices is the notion of perspective: in other words, both groups see the world through different paradigms.

On the one hand, stocks are a leading indicator – they look forward and base movement on future potential – while on the other hand, economies are a lagging indicator – they look backwards and are judged on past data.

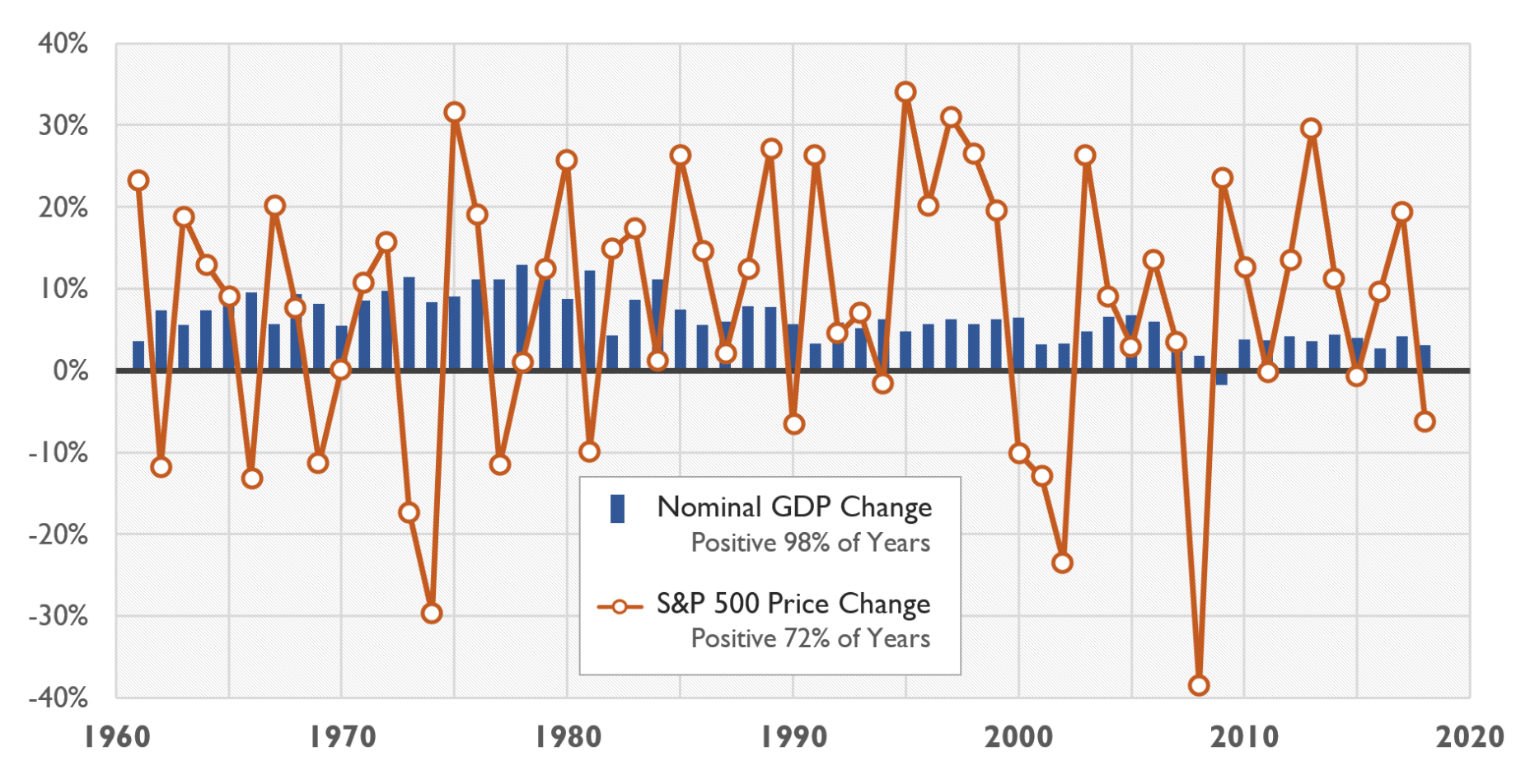

Figure 1: The economy-market relationship is not always positively correlated.

This essentially means that using one to predict the other is hugely misleading. While economic data from two weeks ago could suggest financial Armageddon in the near term, investors in the market could still foresee next year as profitable across all asset classes.

In this case, the forward-looking nature of investors would see them foregoing current economic data and deploying their cash into the capital markets instead. In turn, this would stimulate stock prices even if a country is suffering at the moment.

The spectre above works in almost perfect unison with current global affairs: economies – both emerging and developed – have been ravaged by COVID-19 while their stock markets are still flourishing. The MSCI World Index is up 4% against a global economic drop of 32.9% last week, a clearly unsynchronized relationship that proves a twofold thesis:

Such data could include surveys of hedge fund managers’ predictions or forecasts of company earnings. Both of which would provide us with a clearer perspective on the near-term future of stock prices instead of backward data that does not necessarily link with future asset values.

The second detractor of the economy-stock market marriage is the idea that any economic misgivings are already reflected in the price.

“It’s not that the stock market should go lower after bad economic news: the market is where is it BECAUSE of the bad news. If things weren’t bad, prices would be even higher.”

– Larry Swedroe, CRO Buckingham Strategy Wealth.

In other words, poor economic data released today cannot translate into a stock market slump tomorrow: asset prices have already taken the economic front into account. They are sitting where they are because of such consideration.

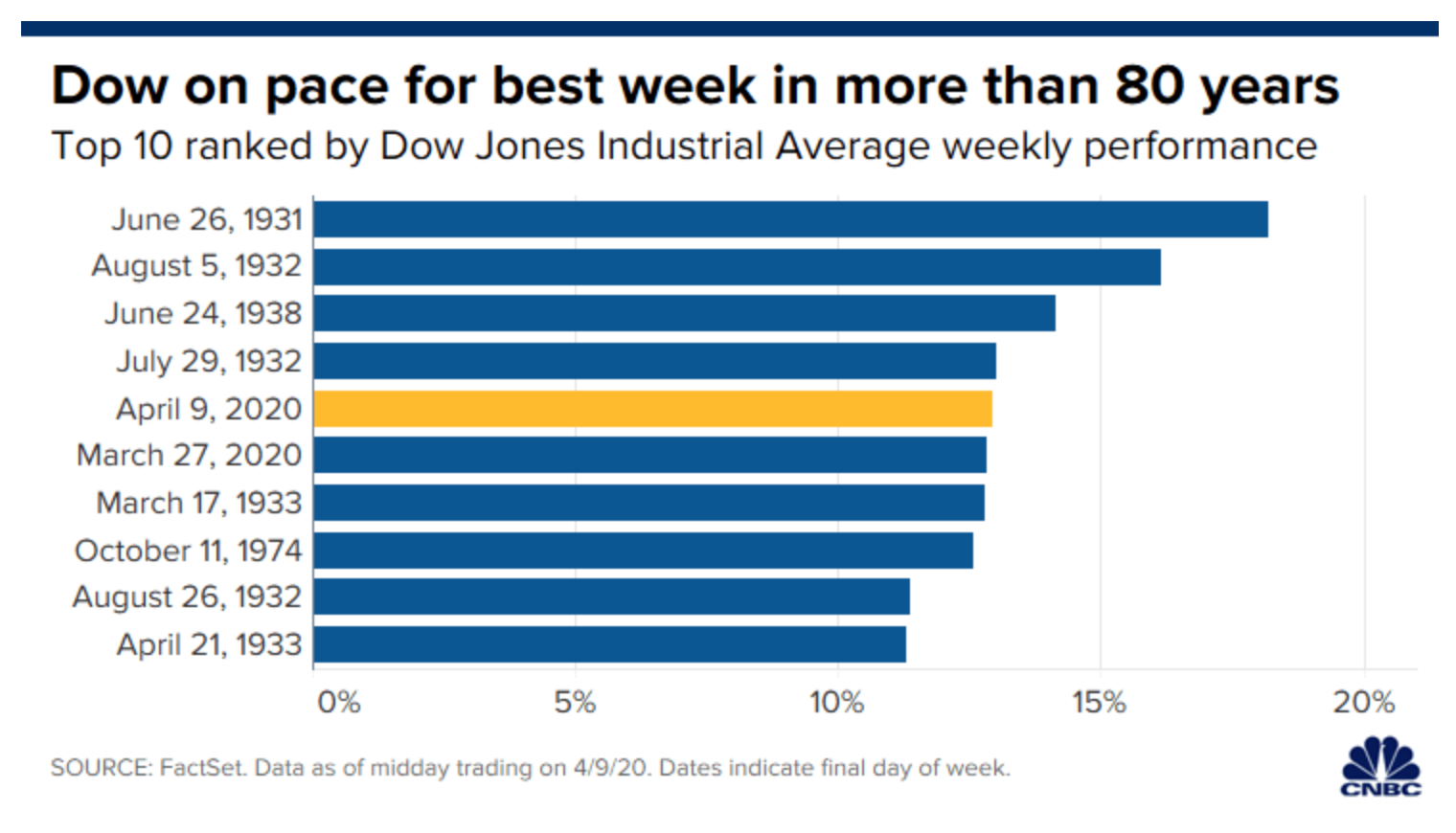

The chain of events above most recently materialized at the beginning of April: just as 6.6 million Americans filed for unemployment on the 9th, markets were expected to plummet but instead roiled upwards, with the Dow Jones Index closing over 1000 points in the green by day’s end. I.e. investors already accounted for high job losses and therefore piled into stocks assuming the worst is over.

Figure 2: Markets overshoot in April even as unemployment data worsens.

For the retail investor, this means that we should avoid reacting to weekly economic quagmires that point to bearish behaviour (high unemployment claims, low non-farm payrolls, low housing) because Mr Market has already factored in these developments.

Instead, focusing on high-frequency data – data that comes out on a daily or even hourly basis, such as restaurant bookings, the volume of shares traded, retail traffic – would give us a better idea of real-time improvements.

As the time between this data being noted and the delivery to investors is marginal. Such statistics would, therefore, provide insights that more closely relate to movement in the financial markets.

Although the narrative above suggests that we should avoid using the economy to fuel investment decisions, there are subtle nuances that still need to be considered.

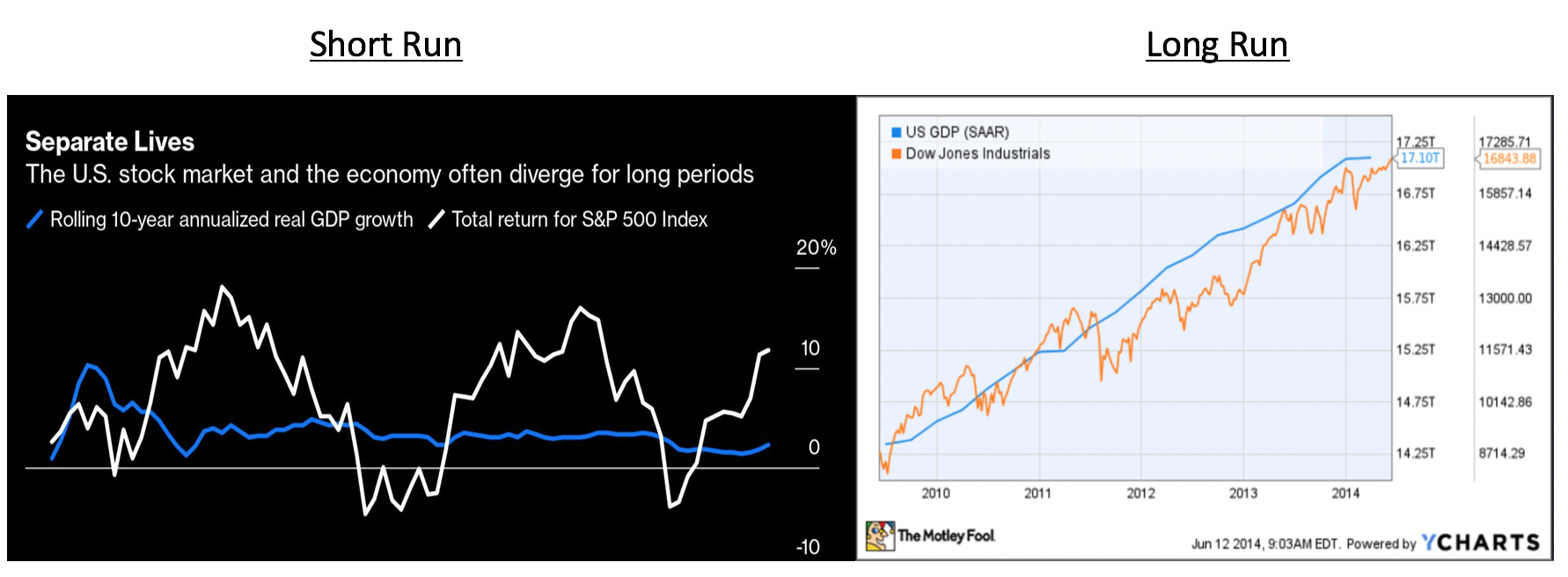

The relationship between economies and markets clearly shows little correlation in the short-term. Granted, poor economic data does not lead to plummeting stocks on a daily or weekly basis, but it could do so on a monthly or yearly paradigm if the swell is consistent. In other words, we shouldn’t ignore bearish economic signs (high unemployment/job losses, low investor confidence, deteriorating incomes) if they repeatedly occur over a longer horizon.

Figure 3: Stock market and economy diverge in the short-run, but generally move together in the long-run.

Hence, assuming that the economy is reasonably unrelated to financial markets in the short-term seems a plausible mindset to hold given the graphics above. Still, it would be unwise to ignore the signs showing a long-term correlation between the two paradigms.

“Let’s shift the debate from what the economy is looking like now to what it’ll look like in a year instead, because that’s what investors are betting on.” – Aswath Damodaran, “Dean of Valuation” at NYU Stern.

In other words, avoid using economic data to fuel your near-term investment decisions but certainly keep track of the economy’s dynamic if you’re looking to make long-term bets that highly depend on the former.

This article is an expression of my thoughts about the markets and is posted here for the benefit of the larger audience. However this cannot be constituted as Investment Advice. Please discuss with your financial advisor for expert and personalized advice on your investments.

Saahil Menon is an undergraduate student at the London School of Economics and chief content writer of his blog, The Dividend Payout. Through his financial columns - featured on his website, Gulf News and various other outlets - he aims to simplify finance for teenagers and encourage them to begin investing during their youth. His internship experience with the Abu Dhabi government and Lazard’s investment banking division has also expanded the scope of his articles: allowing both a local and global perspective on current market affairs.

Sturm and Drang are perhaps the right words to describe the prevailing global market situation.

-2.png?width=300&name=WEEKLY%20MARKET%20UPDATE%20-%206th%20August%202023%20(350%20%C3%97%20250%20px)-2.png)

After robust growth in July, global equities declined in the first week of August.

-2.png?width=300&name=WEEKLY%20MARKET%20UPDATE%20-%2031ST%20JULY%202023%20(350%20%C3%97%20250%20px)-2.png)

The summer temperatures and the stocks on Wall Street have been soaring high in the last few weeks....