Financial Wellbeing, 30 Days Challenge, Win with Money,

30 Days Win With Money Challenge

The last three years were challenging on multiple fronts, and money was one of them for many of us.

Expat couples move to UAE / Middle East to enhance their overall well-being, particularly their finances.

They intend to grow wealth faster by making the best use of their higher disposable income.

However, many couples are unable to succeed financially. They seem to be stuck in a rat race and are usually worried about money and the uncertainty of their future.

Their typical worries are;

They remain stuck in a rat race, bogged down by typical challenges expat couples face.

This post discusses the Top 6 challenges you can face as an expat couple looking to grow wealth and secure your financial future.

Addressing the above challenges can help you get out of the Rat race quickly, enhance your financial well-being and secure your financial future.

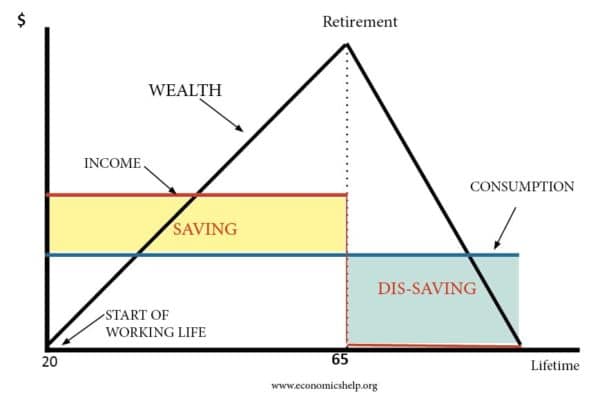

A young couple moved into UAE in 2019. Let's call them Mr. & Mrs. Kumar.

One of them worked in the IT industry, and the other was in the hospitality industry. They had two children, 4 and 6.

Both were young, well educated, and earning handsomely; but they had little savings as they had just started building wealth.

Inspired by their peers and friends(Predecessors), Kumars rented a townhouse in an upscale locality and enrolled their children in an international school. They also spent a fortune furnishing their house.

Unfortunately, one of them was laid off during Covid and could only get another opportunity late last year.

In the meantime, they had to further dip into their savings and had to borrow to stay afloat. Now they are at least 4-5 years behind their wealth curve.

Source: https://www.economicshelp.org/blog/27080/concepts/life-cycle-hypothesis/

While Covid was unexpected and unfortunate, Kumars could have managed things better had they ignored the temptation to keep up with their predecessors.

At least, they would not have had to borrow if they had budgeted to live on one income and save the other.

UAE offers a great lifestyle. However, it comes at a cost. New expat couples tend to benchmark their lifestyle with their predecessors, who have come years before. They might have had the savings and income to build their lifestyle over time.

There is nothing wrong with aspiring to build a similar or better lifestyle, but wanting to have it immediately, would mean dipping into your savings even before income has started coming in. Some even borrow to keep up with their predecessors.

Ideally, working couples should aim to live on one person's income, save and invest the rest. Single-income families can start building wealth using Elizabeth Warren's 50/30/20 Rule and the Pay Yourself first strategy.

During the GAiM plan session with couples, I usually ask them how long do you intend to live and work in the UAE?. The typical answer is "as long as our job is!"

Although UAE and many other countries offer Golden Visa and or a few other long-term or employer independent residency options, expats are still concerned about uncertainty around employment and residency.

Hence they assume that life as an expat is temporary and might have to leave at any time. While there is some element of truth in it, it is far from reality.

People come to UAE thinking they will spend two or three years or accumulate a certain amount of wealth and return. However, they end up living much longer than initially anticipated. The comfortable lifestyle and opportunities in UAE/Middle East encourage expats to live here longer. Also, their goal post keeps moving over time.

Many expats have lived here for decades and made UAE/Middle East their home. They have invested in properties, started businesses, and are flourishing here. Their children were born and raised here, and even they have started their own families here.

Young expat couples can do much better if they think long term and plan accordingly. The first step to mitigating the uncertainty around employment and residency is having adequate emergency savings.

You should plan and create an emergency savings of 3 - 6 months of income to help you manage a family emergency or a job loss. This will help you and your family sustain in the UAE during difficult times. It also will give you sufficient time to choose the right job opportunity instead of having to latch on to what comes your way.

You can also use the 3 Bucket investment approach to enhance your financial well-being. It helps you plan and invest for your short, medium, and long-term goals.

Moving to a new country is not easy. People leave behind their families, parents, friends, and homes to start afresh as an expat.

Many couples manage more than one household with their income, supporting parents or siblings or paying Mortgages or other loans back home.

Some middle-aged couples also fund their children's higher education and living costs abroad while supporting their parents.

Managing more than one household can be a challenge even for dual-income families. Planning efficiently and setting up passive income vehicles for funding dependent family expenses and investments for Children's college fees can be a good idea.

A Budget Planner and a Networth statement can be handy here. It can help you plan and track your overall expenses and efficiently manage your combined assets and liabilities. It can also help you realize if you are making progress every year, just surviving or borrowing to survive.

We cannot succeed all by ourselves. We need help from experts from different professions to lead our lives comfortably, like doctors, Schools, Grocery, Plumber, electricians, etc. Similarly, you will need the support of financial professionals like A Financial Advisor, Tax Consultant, and Banker to help you make the best of your expat income.

Identifying and creating your own Mastermind group can improve many areas of your life, including your finances.

If you already have a financial planner/Advisor in your Mastermind group, great. If not, arrange a complimentary discovery call to understand how I can fit into your mastermind group and help you enhance your financial well-being.

Rent can be a significant portion of your expenses as an expat, and buying your own house can always be tempting. Buying a home or an investment property can save you money and help you build wealth.

On the other hand, it can also lock up your liquidity and trap you in a long-term loan commitment. It also involves a significant downpayment to buy and Maintainance costs to upkeep the property.

We have seen both good and bad days with real estate in UAE and the Middle east. We have also seen people make/lose loads of money in real estate.

How can you be sure if you are making the right decision?

With rising inflation, interest rates, steep property prices, and prevailing uncertainty, how can you ascertain if the real estate investment you are planning is an opportunity or a threat?

You can use one of the many calculators to determine if you should rent or Buy. Here is one from Propertyfinder if you are in the UAE.

You can also consult your Trustworthy and expert mastermind community to give your unbiased specialist opinion on whether you should rent or buy.

Money is the most prominent reason for disagreement between couples, and it is also No 2 on the list of leading causes for divorce.

Source: https://www.ramseysolutions.com/relationships/the-truth-about-money-and-relationships

Many couples tend to refrain from conversations around money or their Financial Future to avoid confrontation. Another study confirms that 1 out of 3 couples dread talking to each other about finances.

Source: https://www.businesswire.com

Source: https://www.businesswire.com

It can be difficult to achieve financial success when couples are not aligned on money and the future.

While one would want to spend, the other would like to save. One of the spouses may wish to prioritize retirement, and the other would insist on focussing on children's higher education. Or one might want to rent, and the other could be dreaming about buying a house.

One of them would want to borrow more, and the other would like to be debt-free.

Such differences could lead to indecision, procrastination, or worse, financial blunders made in a hurry or in secrecy.

Bringing in a professional unbiased and professional financial advisor can help the couple see things from a different perspective. It can motivate them to work together on the goals and follow the agreed-upon action plan. It also helps them avoid unnecessary conflicts around money or the future.

So these were the Top 6 challenges faced by expat couples when looking to grow wealth. Having a Holistic Financial Plan, disciplined savings, efficient investment advice, and regular review of your financial plan and investments can help you overcome these challenges and build a robust financial future.

As a financial advisor for over a decade and working with 500+ families, I have realized that wealth and prosperity go way beyond money alone. Arrange a Complimentary Session to enhance your financial well-being and secure your future.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

The last three years were challenging on multiple fronts, and money was one of them for many of us.

Do you realize that?

Employees' loss of productivity and effectiveness due to financial stress can...

Investors have a love-hate relationship with cash.

They try to sell everything, switch to cash...