Weekly Market Update

When will the selling stop?

Despite another stellar earnings season and positive data on retail sales, the geopolitical...

The U.S. equities ended in the week in red amidst renewed fears of the resurging delta variant and higher than expected inflation numbers. Supply chain bottlenecks continue to push prices up globally.

During the week,

Experts see Caution creeping in, despite a negligible drop in equities as global growth slows down and central banks are looking to reduce stimulus.

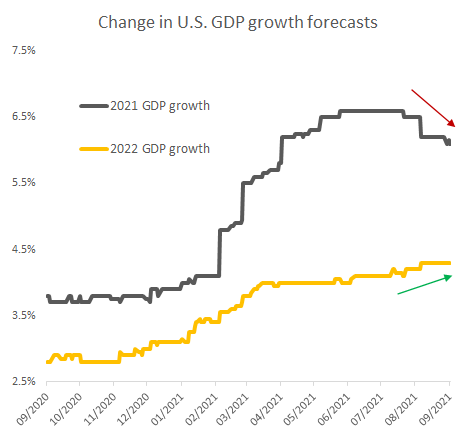

The growth outlook for 2021 is being revised from 7.00% in July to 6.00%, thanks to;

While the delta variant and inflation numbers forcing investors to tread cautiously, all is not lost.

Chart showing change in U.S. GDP growth forecasts over the past year. Since August 2021 estimates have declined, while 2022 estimates have risen some.

Source: Edwardjones.com

Shares in Europe were also down due to Pandemic woes, uncertain growth outlook and central bank policy.

Japanese equities continued to grow, fuelled by political optimism and additional stimulus expectations under the new prime minister.

The Nikkei 225 Index was up by 4.30%, and the broader T.O.P.I.X.T.O.P.I.X. Index rose 3.78%.

Chinese equity continued to rise for the third consecutive week. Thanks to solid trade data and the recent conversation between presidents Biden and Xi Jinping.

In India, the Sensex and Nifty were up marginally by 0.30% and 0.26%. The Mid-cap and small-cap indices advanced by 1.33% and 1.24%

While a mid-cycle slowdown is potentially brewing, the market fundamentals are still strong. Equity markets are expected to grow slower than the last 18 months and with higher volatility.

As a retail investor, it would be better to focus on your personal goals and investment horizon than the market sentiments.

If you are investing for long term goals, stay invested in a diversified equity portfolio. And if your investment horizon is short, skew towards cash, gold and fixed income.

Also, remember that bull market corrections are unpredictable and typically short-lived; hence, looking to time the markets may not be a good idea. Instead, focus on building a balanced portfolio diversified across sectors, geographies and asset classes.

Including cash, bonds and gold can help mitigate volatility and be used for rebalancing and buy equities when markets correct.

Whether it is Holistic Financial Planning, Investment Advice, Life and Critical Illness Insurance, or robust portfolio management, whatever your needs are, we can help. Arrange a free consultation now.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2.jpg?width=300&name=Flight%20to%20Safety%20(350%20%C3%97%20250%20px)-2.jpg)

Despite another stellar earnings season and positive data on retail sales, the geopolitical...

A Will is a legal document, stating how you want to distribute your wealth and who...

This seminar is full of unique ideas, new concepts and...