Weekly Market Update, Nasdaq,

A Bumpy Ride - Weekly Market Update

Last week, the US equities were in the red for the second week in a row.

Even though the latest market swing has formed one of the best weeks since March 2020, the days from November 3rd onwards were still filled with angst, uncertainty, and repeatedly changing narratives.

Finally, some closure.

Joe Biden and Kamala Harris are officially projected to take the White House, and now the question going forward is twofold:

How can we prepare for the incoming political “gridlock” (as Trump begins to take the vote to court), and

How do we invest when Biden is conclusively declared as the winner?

In the gridlock paradigm, markets are likely to remain stagnant while we wait for confirmation of vote recounts and court decisions: in other words, expecting a movement as enjoyable as last week is slightly far-fetched.

“Investors are parsing through what this [gridlock/political uncertainty] means for sectors of the economy. Regardless of president, sectors like clean energy and tech all tend to benefit in this gridlocked environment.” – Sarah Ponzscak, Bloomberg “The Open”

This suggests a potential reallocation of assets: a movement of cash from risk-on companies such as infrastructure, financials and energy into more defensive names in tech and ESG, as mentioned above. Put differently, think of gridlock gainers as the same stocks that would benefit in a lockdown scenario: both situations require investors to wait on democracy to make a final decision, and would therefore call for similar trades being made in the interim.

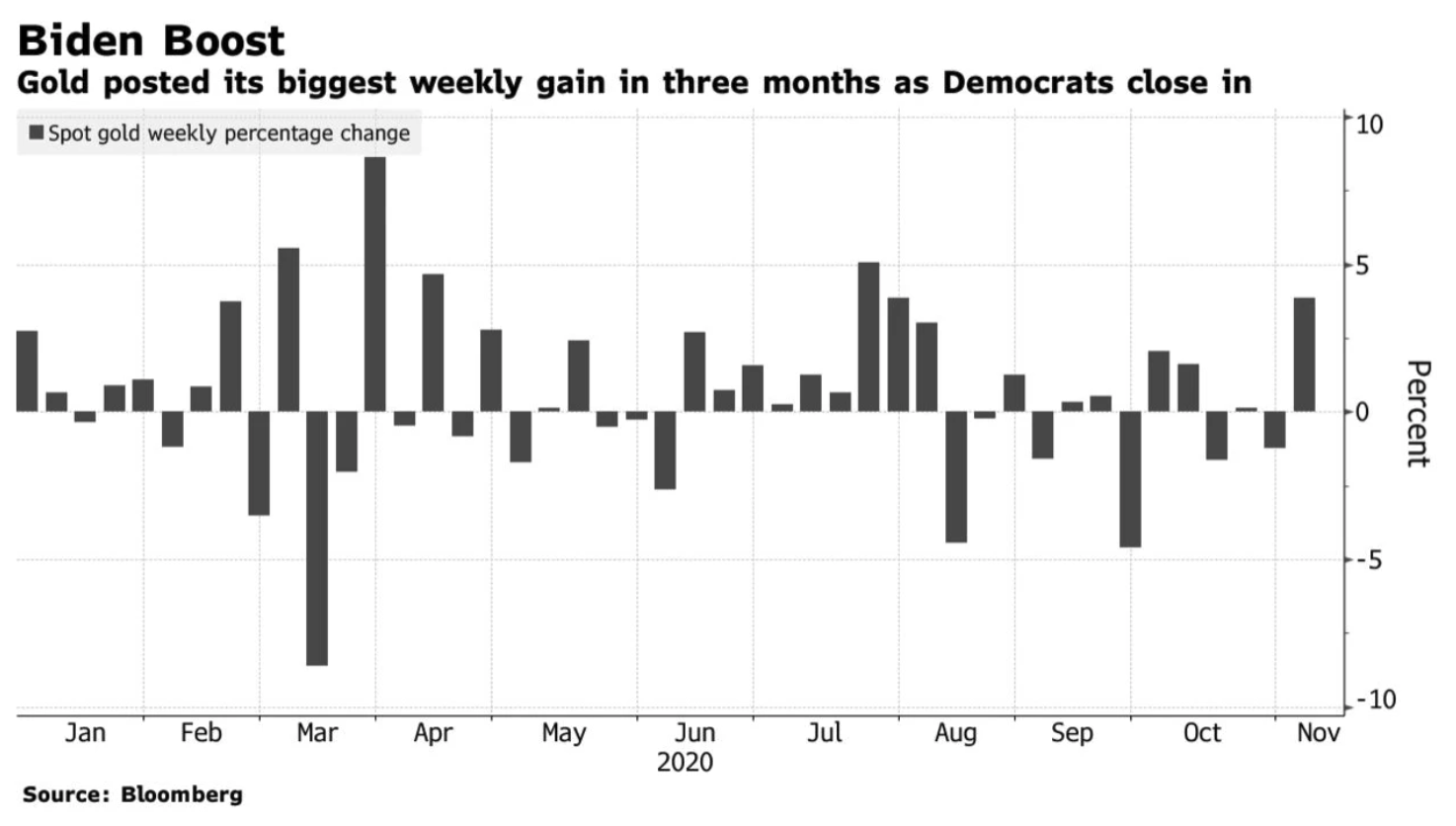

Among the Biden beneficiaries would be a personal 2020 favorite: gold.

Figure 1: Gold’s Monthly Performance This Year

With Joe Biden’s plan of ensuring further fiscal stimulus against the backdrop of COVID-19, a rally to $2000 per ounce of Gold becomes more viable each day. Mass money printing to fund the stimulus would further devalue the dollar (because of basic economics, more supply = lower price) and therefore create a move towards inflation-protected assets such as gold.

Financial parlance aside, the most important thing to remember is simply that Gold and the US dollar have an inverse relationship. When the USD plummets because of ubiquitous money printing, we can expect gold to rally in the exact opposite direction: upwards.

What could go wrong: At the moment, the main argument for bullion prices to surge is a $2 trillion+ support system from the government, but that may not materialize with friction between a Democratic president and a Republican-controlled Senate.

Stimulus bills ordered by the POTUS need to be validated, voted, and then accepted by the Senate for a policy to go through. A divided electorate (when the houses of government are controlled by different parties), although historically favorable to stock markets, make it much more difficult to pass such policies: especially when Republicans are vying towards a much lower stimulus amount.

"Control of the Senate remains on a knife-edge, potentially restraining some of the ambitions of president-elect Joe Biden and pointing to a less immediate and smaller fiscal boost." - Camilla Hodgson, FT

One caveat here is that markets have already priced in a relatively meager stimulus, otherwise we should’ve seen gold at $2000+ after the Biden win. This means that investors are already expecting low funding but are likely to be extremely disappointed if the aid amount underplays their already-conservative hopes.

In other words, if the stimulus is under $1-1.5 trillion, investors will likely whipsaw, and markets can expect another gold sell-off.

Cash, cash, cash: Given the upheaval markets have recently seen – a by-product of a Biden win plus positive vaccine news – it’s likely too late to be piling into stocks now.

The main indexes have all hit record (or near-record) highs yesterday, which means that beginner investors would be better off keeping some cash aside and waiting for the next mini correction. With President Trump’s plans of making this transition as turbulent as possible, new investors should not worry about having “missed out”: more opportunities are yet to come.

Gold: Alongside keeping cash aside, beginners can use a small proportion of their overall capital to nibble on gold. The long-term drivers of bullion are still positive, suggesting that the $100 drop yesterday may be a lucrative buying opportunity for those investors who are comfortable with some volatility.

The trading sessions after a heavy gold drop tend to be slightly uncertain, which is why investors who are looking to buy a small amount should do so with low leverage and keep in mind the subsequent price swings.

Europe: Although the S&P500, DJ30, and NASDAQ100 indexes are swollen beyond measure, beginner investors can still pursue index investing with the European equivalents: namely FTSE100 (UK) and the DAX30 (Germany).

These are still undervalued and tend to perform much more predictably relative to the three US indexes: making them a more suitable option to trade up-and-down for those newer to the market.

This article was first published on my personal blog https://www.thedividendpayout.com/.

It is posted here for the benefit of the larger audience. However this cannot be constituted as Investment Advice. Please discuss with your financial advisor for expert and personalized advice on your investments.

Contact: saahilmenon2000@gmail.com

Saahil Menon is an undergraduate student at the London School of Economics and chief content writer of his blog, The Dividend Payout. Through his financial columns - featured on his website, Gulf News and various other outlets - he aims to simplify finance for teenagers and encourage them to begin investing during their youth. His internship experience with the Abu Dhabi government and Lazard’s investment banking division has also expanded the scope of his articles: allowing both a local and global perspective on current market affairs.

Last week, the US equities were in the red for the second week in a row.

This is the weekly market update as of 10th January 2022. Tune in every week for news, views, and...