Weekly Market Update

Who let the bears out?

Last week, the bears were out, busy pushing down the growth assets and scaring the bulls away to...

Global Stock markets have been on slippery grounds in 2018, and it seems like they will be more volatile in 2019. We have witnessed 2 significant corrections already this year.

One in February and another in October, when the S&P 500 went down by more than 10% on each occasion.

Financial Institutions and Individual Investors are looking for reasons to sell, at the back of an extended bull run; either to book profits or to protect capital.

The following 4 are likely to be the Key Drivers of markets in 2019.

Many investors, particularly the first time investors have comfortably forgotten the 2008 - 2009 global recession amidst the prolonged bull markets in the last 10 years. But now the winds are changing, and it is time to adjust our sails!

The following are the 4 Key Drivers of Markets in 2019

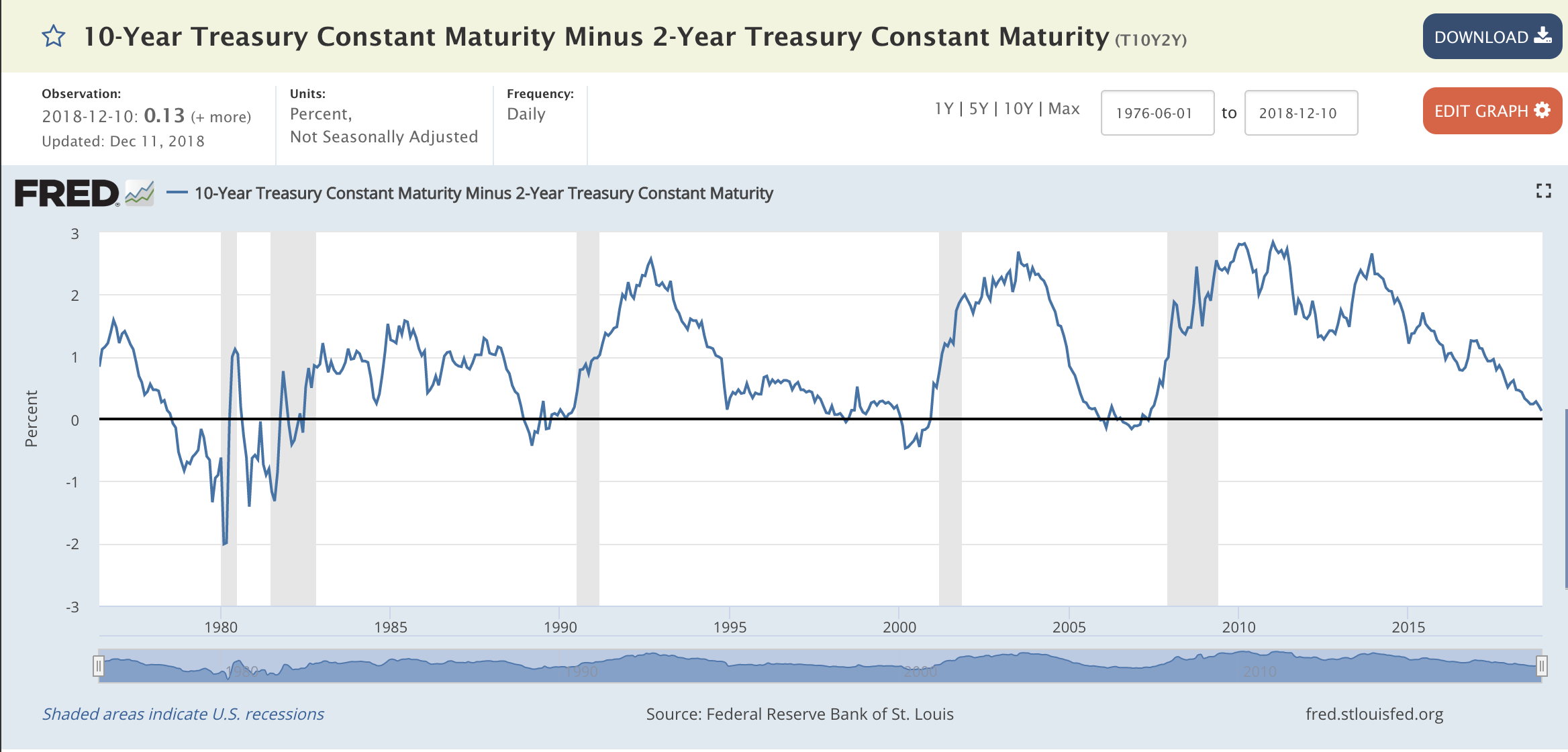

The inverted yield curve is considered to be the harbinger of an economic recession. The inverted yield curve is usually a rare occurrence, but when it occurs, it frightens the financial experts and investors alike.

The last time the Inverted Yield Curve occurred was before the 2008-2009 recession, and before the recessions of 2000, 1991 and 1981.

In layman terms when the interest rates of Short-Term Bonds are equal to or higher than interest rates of Long-term bonds, it is known as an inverted yield curve.

Typically the interest rates of Long-term bonds are higher than the bonds of shorter maturity, but as investors foresee a recession, they begin to buy more of the long-term bonds.

As more and more people flock in to buy long-term bonds, the Federal Reserve responds by lowering the interest rates on the long-term bonds. And because people are not buying the short-term U.S. Treasury bonds, the Fed increases the interest rates to attract investors.

While a recession is not caused by the Inverted Yield Curve, it very likely an advance indicator of a forthcoming bear market. The last 7 recessions in the US were preceded by an Inverted Yield Curve and it seems like another recession is on the horizon.

Although the US and China have agreed to halt new trade tariffs for 90 days from 2nd December, the recent arrest of Huawei’s chief financial officer, Meng Wanzhou is threatening to scale up the trade tensions between these two countries.

This trade war is expected to cause a slow down in the Asia Pacific Trade in 2019. According to The Asia-Pacific Trade & Investment Report by the UN, the growth of exports from the Asia-pacific is expected to decrease to 2.3% as against 4.00% in 2018.

The report also says that global trade has already decreased significantly in 2018. The existing tariffs are expected to cut Global GDP by $150bn and the GDP in Asia by more than $40bn in the next year if these sanctions continue.

The uncertainty of Brexit is the pinnacle, as the British Prime Minister faces a vote of confidence later today on her Brexit Deal with the EU.

Whilst the deadline of 29th March 2019, when the U.K. is scheduled to leave the EU is not very far, many aspects of the withdrawal including the withdrawal itself are still uncertain.

This can contribute to a lot of volatility in 2019, forcing the investors to sell off and fall back on safe havens like Cash, Bonds and Gold.

The ECB had announced earlier this year that it will reduce its Quantitative Easing program from €30 billion per month to €15 billion per month till October, and then to end QE altogether in December.

ECB's aggressive QE program had brought down interest rates in Europe, which helped to a certain extent in keeping the interest rates low in the US and elsewhere around the world.

While interest rates are not going to rise in Europe until the end of 2019, the lack of liquidity and the anticipation of higher interest rates is going to be a concern in 2019.

In addition to the above, the following factors may also contribute to uncertainty and volatility in 2019

Although undesirable, intermittent Stock Market volatility is inevitable, because investors hate uncertainty and are known to react apprehensively to the changing economic, geopolitical and corporate environments.

Although undesirable, intermittent Stock Market volatility is inevitable, because investors hate uncertainty and are known to react apprehensively to the changing economic, geopolitical and corporate environments.

As a prudent investor, it is essential to focus on long-term goals and refrain from a knee-jerk reaction to negative sentiments and gloom predictions on the TV, Internet and Social Media.

The Quote from Peter Lynch is an ideal guide in this scenario...

“More money has been lost trying to anticipate and protect from corrections than actually in them.”

Have an open discussion with your financial advisor on how these events can affect your portfolio. If your goal is at least 4 -5 years away, then it is unlikely that these events will have any negative impact. If possible use this opportunity further invest in funds suiting your long-term goals and attitude to risk.

Read: 5 Rules for Successful Investing

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Last week, the bears were out, busy pushing down the growth assets and scaring the bulls away to...

As you might already know that the Tick-a-week savings challenge starts on 1st January 2019.

This...